Queen Elizabeth II and the Duke of Edinburgh visited the UAE in February 1979, arriving on the Royal Yacht Britannia, and dropped in on a lecture by a pioneering academic on England's best-known playwright, it can be revealed.

The encounter with Prof Amel Amin-Zaki, professor of Shakespearean drama, was a highlight of the royal tour of the United Arab Emirates University in Al Ain.

Now the lecturer's son, Feisal al-Istrabadi, a lawyer and former diplomat who was Iraq's deputy representative at the UN from 2004 to 2007, has recalled the circumstances from his home in the US state of Indiana.

Prof Amin-Zaki and a colleague were asked to prepare special talks appropriate for a royal visit alongside the UAE Founding Father, Sheikh Zayed. The idea was to give the queen a flavour of academic life at the fledgling university.

"For my mother, the choice of topic was obvious," Mr al-Istrabadi said. "She was an expert on the translations and performances of Shakespeare’s works in Arabic. She focused on her favourite play, Hamlet, and the debut performances of it in the Arab world.

"The first translators knew that Hamlet was a tragedy and knew how it ended. But the first Arab producers of the play for the stage did not like Shakespeare’s ending.

"I recall my mother saying that they did not think their audience at the time would appreciate a denouement in which every major character apart from Horatio dies.

"So the first Arabic production of Hamlet was cleaned up. Hamlet kills Claudius, ascends the Danish throne and announces his intention to marry the very-much-alive Ophelia. As the play ends, the ghost of Hamlet’s father appears on stage, smiles and nods approvingly.

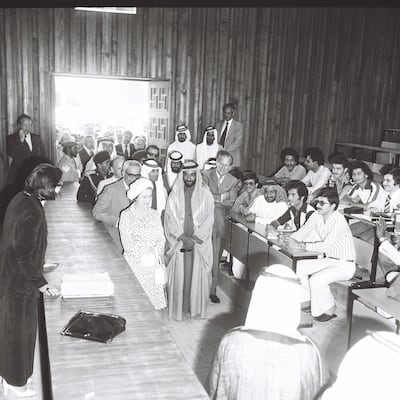

"It is at this instant, just as my mother was finishing the lecture by describing the ghost’s reappearance, that the photograph was taken. The queen, seemingly genuinely delighted by my mother’s telling of the tale, appears to look back at the Duke of Edinburgh, who was slightly off camera."

Mr al-Istrabadi, a professor of Central Eurasian studies, says his father told him that the day his mother came home from meeting the queen was among the happiest he had seen her. A woman who was reserved by nature, she would say the monarch was even more beautiful in person, that photographs did not do her justice, always commenting on her penetrating blue eyes.

After the lecture, Queen Elizabeth spoke to the students. While she did so, Prince Philip asked Prof Amin-Zaki about her background and how she came to be interested in English literature.

"Later that day, as the visitors were leaving the university, my mother took her class to be among those lining the way when the party passed," Mr al-Istrabadi said.

"The duke saw her and said, 'There she is.' My mother responded, 'You remembered me, sir', to which he replied, 'Of course'.

"The photograph recording the encounter was framed and on display in my parents’ home and my mother would delight in recalling the details when asked. Meeting the queen and the duke was a lasting memory for her, one she cherished."