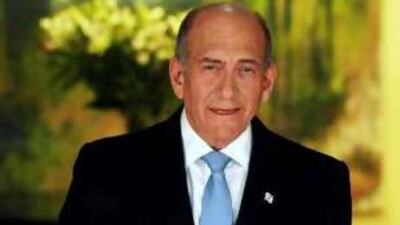

RAMALLAH // Ehud Olmert, the Israeli prime minister, effectively resigned his post last night in a dramatic announcement from his official residence in Jerusalem in which he said he would not contest his party's leadership elections on Sept 17. Mr Olmert has been labouring under intense public scrutiny since the Israeli police opened an investigation in May into corruption charges surrounding his time as mayor of Jerusalem. Asking himself what was more important, his "personal justice" or the interests of the Israeli public, Mr Olmert, who protested his innocence throughout his speech, said the "interests of the state" had to come first. "Therefore I will not contest Kadima leadership elections and I will accept their result with my blessing. When a replacement is elected, I will resign my post as prime minister." The announcement has left the field open to the two main contenders vying for the post, Tzipi Livni, the foreign minister, and Shaul Mofaz, minister for transport and a former army chief of staff. The two candidates are running neck and neck in the race, though polls show Ms Livni, a relative political newcomer, slightly ahead. The Israeli foreign minister yesterday cancelled a press conference she was due to give in Washington, where she is meeting Palestinian negotiators and American mediators, while Mr Olmert made his announcement. Ms Livni has surrounded herself with former advisers to Ariel Sharon, who broke away from the right-wing Likud party to create the Kadima party before general elections in 2006 that a massive stroke prevented him from contesting, leaving Mr Olmert to take the reigns. If she wins the party race, she is likely to pursue a similar course to Mr Olmert in terms of negotiations with both the Palestinians and Syria, the latter of which appeared to have been gathering pace. Mr Mofaz is seen as more of a hawk and caused a stir a month ago with a statement that Israel would eventually be forced to attack Iran if Tehran did not back down from pursuing its nuclear programme. In Mr Mofaz's favour, Ms Livni would likely find it harder to maintain the present government coalition because of the importance of the religious Shas party, which might be reluctant to sit in a coalition under a female prime minister. Mr Mofaz will also play on his extensive army experience to suggest that he would be a safer pair of hands compared to Ms Livni, who comes from an intelligence and academic background. "Mofaz is a more adept political operator in terms of getting his supporters out to vote for him," said Yossi Alpher, an Israeli analyst. "Livni has a squeaky clean image, which may stand her in good stead, but she also suffers from the perception that she is not able to rough it with the boys." Mr Alpher suggested that should Mr Mofaz get elected, Kadima is likely to take a turn to the right, and become a "Likud II" party, whereas Ms Livni would be more likely to "hit the ground running" with respect to the negotiations processes with both the Palestinians and Syrians. In his speech last night, Mr Olmert said he would continue to pursue negotiations with all Israel's neighbours, but his impending resignation makes it almost impossible for such negotiations to gain any traction. While Palestinians for months have complained that the Annapolis process has been stalled, it is likely to have more of an effect on the Syrian track, which has shown some early promise and where negotiations appeared poised to go from indirect to direct contacts. "This would delay proceedings if there were proceedings to delay," said Ali Jarbawi, a Palestinian political analyst, who said he saw no major difference between the two contenders now likely to lead Israel. "But since there is nothing to interrupt, there is no major change. [Mr Olmert's resignation] is a minor detail." okarmi@thenational.ae

Olmert to step down in 'interest of the state'

Ehud Olmert announces he will step down when his ruling party chooses a new leader in September.

Most popular today