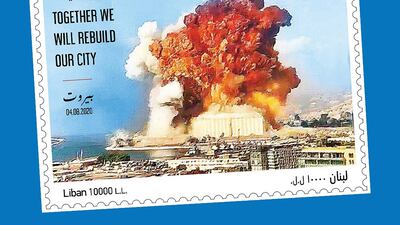

Lebanon’s national post office is under fire for launching a commemorative postage stamp showing the August 4 Beirut blast.

The new stamp from LibanPost will be sold for 10,000 Lebanese pounds ($6.50) and features a photograph of the blast as it ripped through the capital, along with the caption “together we will rebuild our city” and the date of the explosion.

The huge blast, felt as far away as Cyprus, killed at least 191 people and injured more than 6,500 others as buildings collapsed and windows shattered.

“The needs for reconstructing the infrastructure, for equipment and for first necessities remain so massive, that help should not be suspended,” LibanPost’s managing director Khalil Daoud wrote announcing the new stamp.

“To be of service, LibanPost decided to issue a “postal bloc/stamp” commemorating the dramatic Beirut Port blast,” he wrote.

All proceeds would go to the Lebanese Civil Defence, he added.

Although seemingly well-meant, the gesture was met with consternation.

“Someone needs to get fired over this tasteless LibanPost Beirut Blast stamp,” one user wrote on Twitter, sharing a photo of the stamp.

Underneath the Facebook post announcing the new stamp, one user wrote: “This is not right. Commemorating mass trauma and murder. Shame.”

“Very disrespectful, even if the intention is good!!” wrote another.

Others were in enthusiastic support of the initiative. "At least someone thought of the civil defence!" one commenter wrote.

Some agreed the idea of raising money for the Civil Defence was positive, but suggested a different photo would have been a more sensitive choice.

“The remnants of the silos would have been acceptable,” a Twitter user wrote. “This is insensitive to all Beirutis who have suffered. It is symptomatic of the apathy and lack of responsibility displayed since August 04. Shame!”

The large grain silos at the port likely shielded parts of Beirut from the worst of the explosion and remain a twisted and shattered shell.

LibanPost said the stamp was an effort to "confront our history".

"We respect all opinions and we consider that they are all different point of views whether regarding the timing or the design," Ronnie Richa, head of marketing at LibanPost, told The National.

"History is written through the stamps and important events are immortalised on stamps in order to keep remembering and move forward and beyond," he added.

"The picture of the blast is important to illustrate this dramatic event for the future generations' perception."

It is not the first time that LibanPost has drawn questions over its decision to issue collectables. Earlier this year, at the height of the banking crisis and as the unofficial rate of the Lebanese lira dropped from 1,507 to more than 9,000 against the dollar, the company announced that it was selling uncut sheets of freshly minted bills.

The five notes by eight notes sheet of 50,000 lira bills sold for 2,200,000 lira ($33), a markup of 200,000 lira.

Many asked why the postal company was making such a move during a financial crisis.