Egyptian President Abdel Fattah El Sisi on Sunday pleaded with his 100 million people to show more “commitment, responsibility and discipline” in battling the coronavirus outbreak over the next two weeks.

“I don’t want to scare you but I am saying to all Egyptians that we want to get through the next 14 days with as little damage as possible so that, God willing, we are out of this critical stage,” Mr El Sisi said in a televised address.

He said Egyptians must do more to prevent the virus from spreading widely, warning that failing to limit social interaction could lead to thousands of infections in days.

Mr El Sisi urged his people not to hoard goods, reassuring them that there would be no shortages.

The president on Saturday appointed an adviser for health and preventive medicine.

Mr El Sisi also sought to put to rest rumours that the government was concealing the true number of people infected and dying.

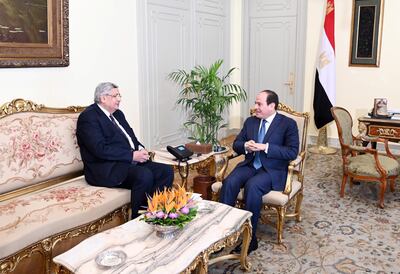

“We never kept anything from you right from the start of the crisis, but there was still scepticism," he told a gathering of women at the Presidential Palace in the Cairo suburb of Heliopolis.

"Why would we keep anything from you? Is it something that’s unique to Egypt?

"No, it’s all over the world and its impact is felt across the globe. We are not an exception. We are dealing with the crisis with complete transparency."

Egypt had reported almost 300 cases of Covid-19 by Saturday, along with 10 deaths, which are relatively small numbers given its population and modest healthcare system.

Without mentioning it by name, Mr El Sisi blamed the rumours on the now-outlawed Muslim Brotherhood, the group whose stalwart Mohammed Morsi was elected president in 2012.

Morsi was in office for a year when the military, then led by Mr El Sisi, removed him amid mass protests against his divisive rule. Mr El Sisi was elected president the following year.

He has since adopted a hands-on approach to nearly every facet of life in Egypt, holding near-daily meetings with his prime minister and cabinet members.

Mr El Sisi has discussed on live television the minute details of the dozens of mega infrastructure projects he has launched.

But until Sunday, he opted to orchestrate the government’s response to the coronavirus from behind the scenes.

Over the past week, Mr El Sisi has ordered university and school classes to be suspended, banned large gatherings, halted international air travel and set aside 100 billion pounds (Dh23.34bn) to battle the coronavirus.

His government also announced a stimulus package to avoid an economic downturn at a time when the country’s economy was finally showing signs of recovery after years of turmoil.

On Sunday, Mr El Sisi announced a 14 per cent rise in pensions effective from the new fiscal year starting on July 1.

He ordered the central bank to boost the badly hit stock market with 20bn pounds.

Last week, the government reduced power charges for industries, suspended taxes on stock market transactions and allocated one billion pounds to help exporters.

It cut interest rates by 3 per cent to encourage investment and gave business borrowers defaulting on loan repayments a grace period.

Authorities also closed mosques for two weeks, with calls to prayers to urge the faithful to pray at home, a first in living memory.

That decision was announced on Saturday shortly after Egyptian churches said they were cancelling all services.

“We hope to emerge from this with the least amount of damage,” Mr El Sisi said.

He said he was as worried about the human cost of coronavirus as much as the economic fallout.

“Our people are dear to us and we are also keen to see every human on this planet living in peace and security," Mr El Sisi said.

"We have a moral and religious commitment to see that the Egyptian people are not harmed. Help the state with your steadfastness and resolve.”