It was a hand of cards that soldiers did not play close to their chest, and it paid off.

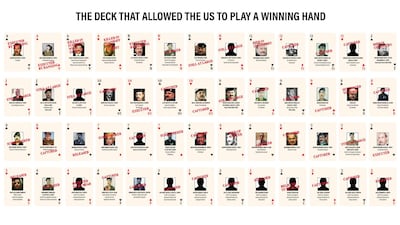

Of the 52 people identified on the "Most Wanted" deck issued by the US military, 43 have been caught, killed or otherwise accounted for. Of the nine that remain at large, four are thought to be dead.

At the top of the pack, was Saddam Hussein, the dictator listed as the ace of spades. His sons Qusay and Uday, the aces of clubs and hearts, and their father's enforcers, came next. All three men have since been killed.

As the king of clubs, and believed to still be at large, is Izzat Ibrahim Al Douri, Saddam's de facto military deputy who served as the vice chairman of the Iraqi Revolutionary Command Council.

Al Douri disappeared after the invasion only to re-emerge as head of insurgency groups, the Supreme Command for Jihad and Liberation and the Army of the Men of the Naqshbandi Order, aimed at destabilising Iraq's post-invasion order.

The former Baathist commander released a video almost 10 years since he was last seen in 2003, condemning the Shia-led government of Iraq. He was reportedly killed in April of 2015 during the military campaign against ISIL but doubts were cast after an audio tape emerged of him purportedly denying his death.

Al Douri is among the few fugitives still believed to be unaccounted for. Thirty regime figures were captured or killed by the US military within a year of the invasion.

Although it is difficult to measure the effectiveness of the cards in capturing members of Saddam's inner circle, the US intelligence officials had designed them with the intention of familiarising soldiers on the ground with the most wanted Baathist officials.

_________________

Beyond the Headlines Podcast: Saddam Hussein's downfall, 15 years on

Fifteen years on, Saddam's legacy and the flaws in Iraq's fractured politics

_________________

The list was also distributed throughout Iraq in posters and handbills and served the extra function of allowing Iraqi civilians to effectively communicate tip-offs to American soldiers. By identifying key Iraqi figures by cards instead of names, soldiers could avoid confusion over the pronunciation of the Arabic names of the most wanted.

The Defence Intelligence Agency, that who issued the cards, said the idea was not unique to Iraq and had been part of American tactics throughout military history. Playing cards became common with troops as a relaxed pastime to fill long hours between marches and battles during the US Civil War.

But it was not until the Second World War that cards began to be used as a method of disseminating military intelligence.

"During World War II, the US military distributed decks of cards featuring the profiles of the aircraft, tanks, and ships of the major powers, on the rationale that such images would help GIs more quickly learn how to distinguish between allied and enemy forces," said Peter Hahn, professor of history at Ohio State University.

The cards were also meant to boost soldiers' morale.

The Iraq war was expected to be a gruelling engagement and by turning the leaders of the Iraqi regime into a game, it could help troops pursue the task.

"Card playing developed over centuries as a pastime and coping mechanism for soldiers at war. Presumably those who developed the Most Wanted cards reasoned that the GIs in Iraq would spend time playing cards for these reasons," said Professor Hahn.

From a collector's standpoint, the cards became almost as sought after as the people printed on them, with the originals going for hundreds of dollars on eBay within weeks of their printing.

One pack, however, was worth thousands, according to a report by the New York Post.

Mark Heinbaugh, a sergeant assigned to a high-value holding facility at Baghdad International Airport, had the unique task of guarding, at different times, dozens of captives among the 52-card deck.

During that time, he managed to have the personalities sign their namesake cards, including the ace of spades himself.

Saddam's card was signed by him and had the word "Victor" written in red marker, which was supposedly the code name given to the former ruler during his time in US detention. It was sold at auction, along with 39 other cards signed by their namesakes, for an unspecified amount expected to be in the thousands.

Even 15 years since their printing, the cards are still found online fetching Dh100 or more and continue to be one the most comprehensive historical records of who was the most wanted in Iraq at the onset of the war.