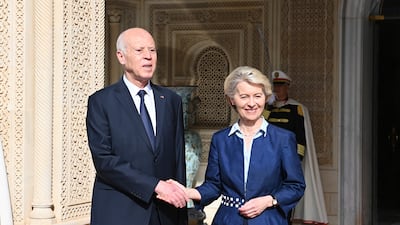

European Commission chief Ursula von der Leyen and Tunisia’s President Kais Saied on Sunday signed an agreement in which Brussels offered to strengthen economic ties with Tunis in return for it fighting irregular migration to Europe.

The migration aspect of the package has been heavily criticised by analysts who say that it will do little to stem the flow of migrants and overlooks human rights abuses.

EU officials, on the other hand, have said that the package is a broad one that will boost the ailing Tunisian economy. It includes investments in the digital sector, transport and green hydrogen.

Here, The National breaks it down.

How serious is the migration issue with Tunisia?

Tunisia lies about 130km from the Italian island of Lampedusa, and has long been a departure point for migrants risking perilous sea journeys on makeshift boats in hopes of reaching Europe.

But trying to get into Europe via the Mediterranean Sea is highly dangerous.

The International Organisation for Migration has said 2,406 migrants died or disappeared in the Mediterranean in 2022, while at least 1,166 deaths or disappearance were recorded in the first half of 2023.

Figures vary according to the routes taken.

The number of migrants that go via the Western Mediterranean route, which includes Tunisia, decreased by six per cent year on year in the first six months of the year, according to the European border and coastguard agency Frontex.

Migrants come mostly from Algeria and Morocco.

The decrease may be attributed to weather and also to Tunisian authorities “stepping up their activities” against illegal migration, according to an EU official who spoke to journalists in Brussels on Monday.

“Interception rates have increased quite significantly so we see a structural trend which is definitely heading in the right direction of avoiding departures,” they said.

The most active route was via the central Mediterranean, where arrivals increased by 137 per cent in the same six months.

Illegal migration has caused political tension in both Europe and in countries like Tunisia, where Mr Saied accused “hordes” of migrants from sub-Saharan Africa of a “plot” to change the country’s demographic make-up.

Far-right Italian Prime Minister Giorgia Meloni has vowed to stem illegal migration and has limited the number of operations of charity rescue ships.

Ms Meloni hailed Sunday’s EU-Tunisia agreement, saying that it should be viewed as “a model to build new relations with North African nations”.

What does the agreement say about migration?

The agreement builds on announcements previously made by Ms von der Leyen during a trip to Tunisia in June, during which she said that the EU would offer Tunisia €105 million ($115 million) to fight people smuggling and enable returns.

Its implementation will be discussed later this year.

“This is nearly a doubling of what we have been doing so far,” said the EU official.

“We are working intensively with [Tunisian] authorities to spend that money in the best possible manner.”

The EU already furnishes search and rescue missions carried out by Tunisian authorities with equipment such as radars and boats.

Brussels wants to support Tunisia with the return of migrants to their country of origin through humanitarian aid to UN agencies including UN refugee agency and IOM.

The EU expects to conclude a new contract in the coming weeks to increase its support, according to the EU official.

Brussels has also requested that Tunisia co-operate to take back citizens who have entered the EU illegally.

The return of illegal migrants to North African countries has proved politically difficult in the past – causing problems particularly between France and Algeria.

The agreement also aims to encourage regular migration from Tunisia to Europe of qualified workers through so-called talent partnerships.

So far, 300 Tunisians currently living in Germany, France and Belgium have benefited from the partnership, the EU official said.

It is up to EU countries to decide whether they want to opt in to the partnership or not. The EU official described it as being “clearly in the interest of both sides”.

An EU-Tunisia association council is expected to be set up before the end of the year to enable discussions.

Why has the migration aspect been criticised?

The migration aspect of the agreement has been criticised because of Tunisia’s poor human rights record when it comes to migrants.

There has been a spate of racially motivated attacks since Mr Saied lashed out against sub-Saharan Africans.

Tension came to a head when a Tunisian man was killed on July 3 in a clash between locals and migrants in the city of Sfax.

Tarek Megerisi, senior policy fellow in the North Africa and Middle East programme at the European Council on Foreign Relations, said: “This deal is an affront to professed European values and will do little to stop migration, just make it easier for Europeans to return the Tunisians that survive the trip.

“Even then, only until Tunisians have a legitimate claim to asylum because of the damage done by an authoritarian President who just received Europe's full support.”

The EU official said that Brussels would only support Tunisia’s efforts in returning sub-Saharan Africans to their home countries if they are done in accordance with international law.

“We only finance returns from Tunisia to the countries of origin in the southern part of Africa that are voluntary,” they said.

“We pay for transport costs, relocation costs, basic needs and the like. We don't do that ourselves – obviously that is mostly the work of IOM.”

The European Trade Union Confederation condemned the agreement, saying in a statement on Monday that it “does not include any conditions on the financial aid that would help to enforce human, workers’ or trade union rights in the country”.

“Europe should aspire to have an ethical foreign policy, but the deal with Tunisia is a good example of an ethics-free foreign policy,” it said.

What else is in the agreement?

The agreement has five key axes: macroeconomic stability, economy and trade, green energy transition, people-to-people contacts, and migration and mobility.

Ms von der Leyen on Sunday said that there were already “good projects” in the pipeline such as the 8,000km Medusa submarine cable which connects North Africa to Europe and is scheduled to be completed by 2025.

The cable will link North Africa’s broadband connections to Europe.

Europe is investing €309 million in the ELMED project – an undersea cable that links Tunisia to Italy.

EU and Tunisian officials will also work on finalising a comprehensive air transport agreement to benefit the tourism sector in Tunisia.

Given its proximity to the European continent, Tunisia is also of interest to EU officials as they work on accelerating the continent’s shift to renewables.

“The production of green electricity in Tunisia could take place at about 2 cents per kilowatt hour,” said the EU official.

“Even our most advantageous costs for industry in Europe at the moment around 10 cents per kilowatt hour.”

In another example of what Ms von der Leyen described as a “win-win situation” for the EU and Tunisia, officials will work on strengthening green hydrogen trade.

The green hydrogen would be produced in Tunisia from solar and desalinated water energy and sent to Europe via four existing gas pipelines.

Regulatory regimes on both sides have yet to be adapted so that green electricity produced in Tunisia can be traded in Europe.