Troops battle through burning streets, missiles take down fighter jets, drones pulverise tanks — the dramatic visuals have the trappings of real-life combat, but in reality they are clips from video games fuelling misinformation.

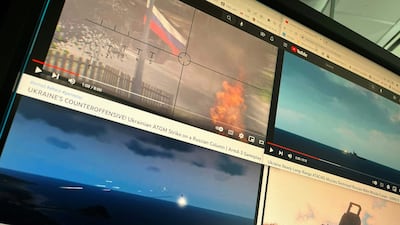

Footage from the war-themed Arma 3 video game is being used repeatedly in recent months in fake videos about the Russian offensive in Ukraine, often marked “live” or “breaking news”.

The frequency and ease with which gaming footage is mistaken as real, even by some media broadcasters, and shared as authentic news on social media highlight what researchers call its serious potential to spread misinformation.

“The fact that it keeps happening is a reminder of how easy it is to fool people,” Claire Wardle, co-director of the Information Futures Lab at Brown University, Rhode Island, told AFP.

“As video game visuals get more sophisticated, CGI [computer-generated imagery] can, at a quick glance, look real. People need to know how to verify imagery, including looking at metadata, so that these mistakes don't get made, especially by newsrooms.”

Arma 3, whose Czech-based developers promise “true combat game play in a massive military sandbox”, allows players to create various battlefield scenarios using aircraft, tanks and a host of weapons.

Players often upload hours of gaming footage on platforms such as YouTube and researchers blame its easy availability for its misuse.

In the comments under one Arma 3 video titled “Ukraine's counteroffensive!” — which simulated a missile strike on a column of tanks — a user, who apparently took it as real, wrote: “We must ask Ukraine after this war to train Nato forces how to fight.”

“While it's flattering that Arma 3 simulates modern war conflicts in such a realistic way, we are certainly not pleased that it can be mistaken for real-life combat footage and used as war propaganda,” said an official with Bohemia Interactive, the game's creator.

“We've been trying to fight against such content by flagging these videos to platform providers, but it's very ineffective. With every video taken down, 10 more are uploaded each day.”

In recent years, Arma 3 videos have been used in false depictions of other conflicts, including Syria, Afghanistan and Palestine, with the clips often debunked by global fact checkers.

The 'first TikTok war'

One clip that claimed to show Russian tanks being struck by US-made Javelin missiles was debunked by AFP in November.

It had been viewed tens of thousands of times on social media.

Bohemia Interactive said the misleading videos have recently “gained traction” in regard to the conflict in Ukraine.

Described by observers as the “first TikTok war”, it is a conflict like no other, as a steady stream of visuals from the front lines — some of it misleading or false — pour on to social media platforms.

Given the unsophisticated nature of the Arma 3 misinformation, researchers say it is unlikely to be the work of state groups.

“I suspect that the people posting this content are just trolls doing it to see how many people they can fool,” said Nick Waters from investigative journalism group Bellingcat.

“Secondary disseminators will be gullible people who pick up this content and circulate it in an attempt to garner fake internet points.”

Bohemia Interactive said the false videos were “massively shared” by social media users, many of whom seek what researchers call engagement bait — eye-catching posts that generate more interaction through likes, shares and comments.

The Arma 3 videos, which its creator acknowledged are “quite capable of spreading fake news”, were also shared by various mainstream media and government institutions worldwide, Bohemia Interactive said.

In a live broadcast in November, Romania TV wrongly presented an old Arma 3 video as battle footage from Ukraine, and a former Romanian defence minister and former intelligence chief offered their analysis of the footage as if it were real.

This occurred after another Romanian news channel, Antena 3, made the same error in February. Among the experts invited by the broadcaster to analyse its video taken from Arma 3 was the spokesman of the Romanian Defence Ministry.

Bohemia Interactive has urged users to use gaming footage responsibly, not use clickbait video titles and clearly state that it is derived from a video game.

Researchers say their videos are relatively easier to debunk compared to “deepfakes” — fabricated images, audio and videos created using technology that experts warn is frighteningly sophisticated and gaining ground in the criminal underworld.

“If you know what you're looking for, these [Arma 3] videos aren't actually difficult to identify as fakes,” said Mr Waters.

“As good as Arma 3 looks, it's still significantly different from reality.”

The fact that many are unable to do so points to another stark reality in the age of misinformation.

“It shows that some people don't have the skills to navigate the current information environment,” Mr Waters said.