The US and French presidents have spoken for the first time since a fierce row erupted over the sale of submarines to Australia, with both leaders agreeing to ease tensions and to meet in Europe next month.

French President Emmanuel Macron was blindsided last week when Australia announced it would scrap a $90 billion conventional submarine contract with France in favour of an agreement for nuclear-powered vessels from Britain and the US.

France was particularly outraged that Australia negotiated with Washington and London in secret, something French Foreign Minister Jean-Yves Le Drian denounced as treachery and a “stab in the back”.

The US frequently touts France as its oldest ally but failed to warn Paris of the new partnership with Canberra and London.

In a nod to France's anger, a joint statement from the White House and the Elysee Palace on Wednesday said “the situation would have benefited from open consultations among allies on matters of strategic interest to France and our European partners”.

Mr Biden and Mr Macron will meet in person in Europe next month “in order to reach shared understandings and maintain momentum in this process,” the statement read.

The statement also said the US recognised the need for stronger European defence to complement the Nato military alliance, a key idea repeatedly floated by the French leader.

In a first concrete sign of a slackening of tension, Mr Macron agreed to send back France's ambassador to Washington after he was recalled to Paris last week in a diplomatic protest.

Relations soured when Mr Biden made a joint announcement with UK Prime Minister Boris Johnson and Australian Prime Minister Scott Morrison to form a US-UK-Australia partnership, nicknamed Aukus.

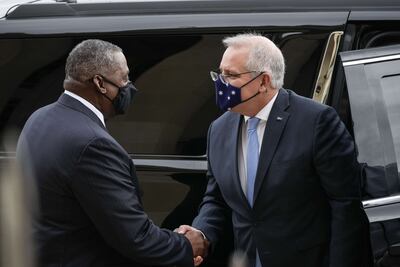

Mr Morrison visited the Pentagon on Wednesday to meet with Defence Secretary Lloyd Austin. In brief remarks to the press, neither man mentioned France, though the Australian premier said he was "particularly looking forward to discussing how we now take Aukus forward and the many projects that I know we will have".

The row has sent Franco-US ties into perhaps the worst crisis since France opposed the US-led invasion of Iraq in 2003, leading to a wave of anti-French sentiment in America, with many restaurants famously calling chips "Freedom fries" on menus instead of French fries.

As well as a huge commercial setback, the loss of the deal was also a major blow to France's security strategy in the Pacific region.

Using mangled French, Mr Johnson on Wednesday told Paris it should “prenez un grip” — or “get a grip".