Cancelled flights, long queues at airports and lost baggage ― it is turning out to be a stressful summer for some holidaymakers.

It is enough to make one yearn for the simpler, more carefree days of aviation, as this photograph shows.

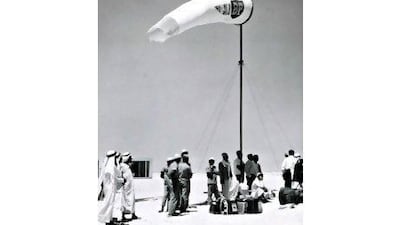

This was Abu Dhabi’s first airport, in the early 1960s. The facilities consisted of a windsock, fuel drum and a fire extinguisher. A rudimentary “no smoking” sign can be seen on the right.

The photograph was taken by David Riley, a British citizen who lived here then, just as a Gulf Aviation flight, most probably from Bahrain, touched down. Gulf Aviation step ladders in the centre of the photograph were used by passengers to disembark. From there, Land Rovers typically took visitors over sand tracks to the town. Just out of shot is the old terminal building.

“It was early evening as I landed and I can still see the sun low in the sky going down over a view of the soft sand, a few palm trees and the occasional barasti house with the Ruler’s Palace [Qasr Al Hosn] in the distance,” Riley says of his first arrival into Abu Dhabi in 1962.

“Some would say it was very ‘romantic'. I must confess I did wonder where I had come to at the time,” he says.

But Riley, who is now back in the UK, says, "I needn’t have worried as it is one of the most enjoyable places I have lived and worked”.

There was only a small expatriate community in Abu Dhabi then. The Club opened in 1962 and construction of the Beach Hotel, Abu Dhabi’s first, finished the same year. The first shipments of oil also left from the emirate in 1962. Riley recalled a few small shops selling basic supplies ― tinned food, cigarettes, condensed milk and rice ― when he first arrived, but at the time a lot of fresh food was flown in on these daily flights from Bahrain.

“Going to the landing strip in the late afternoon to meet the flight from Bahrain was one of the things one did,” says Riley, who worked for the British Bank of the Middle East, which became part of HSBC.

“It was quite common to meet friends there who were in a similar situation. It was also a good opportunity to see who was coming in.”

Riley previously recalled an incident one night when an injured oil worker was taken from a desert camp to Abu Dhabi at night. Because the air strip was not lit, several people drove to the airfield in their Land Rovers and lit it up using their vehicle headlamps, allowing the pilot to take off for Bahrain where the stricken man received life-saving treatment.

But time has moved on. Gulf Aviation has become Gulf Air, while Abu Dhabi’s airport moved to Al Bateen in the late 1960s before shifting to its current off-island location in January, 1982. More than six decades on, Abu Dhabi airport expects at least 10.7 million passengers to pass through its main airport in 2022, more than double last year’s number as business surges back after the Covid-19 pandemic. A huge new terminal ― Midfield ― is also taking shape.

The original terminal building, meanwhile, still stands today in the grounds of Abu Dhabi Media off Sultan bin Zayed the First and Al Salsabeel Street. It is a gentle reminder of simpler aviation times.