Today, life in the Emirates moves in the fast lane. In a regular series to mark the 50th anniversary of the UAE, we take a little trip back in time to see how much the country has changed.

With oil drums marking the runway and a converted Land Rover for a fire engine, arriving in Abu Dhabi was a very different experience decades ago.

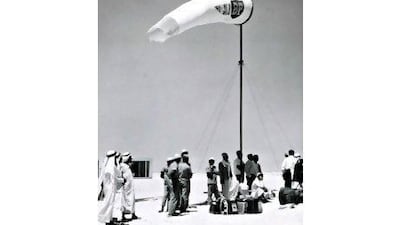

The older photograph, from 1965, shows part of the city’s first airfield. The building is a small control point in which a clerk checked documents, weighed cargo and talked on the radio with incoming pilots. Just out of shot is the sabkha, or salt flat, runway.

The airfield was built in the mid-Fifties and there was no radar. Flights operated visually and pilots had to check the strip was clear before landing or taking off. It was built to support oil exploration by Abu Dhabi Marine Areas. There was another airstrip, on Das Island, which was the main operations base.

De Havilland Doves and Douglas DC-3s were the most common aircraft.

“As the Dove skimmed down the coast over the clear waters and breaking waves on to the deserted beaches west of the town, it was possible to pick out the dark shapes of sharks or rays patrolling the turquoise shallows,” said Michael Stokes, who accompanied his pilot father on many of these flights into Abu Dhabi.

“If we were fortunate, we might disturb a migrating flock of pink flamingos, who would spread out in their enormous formation so we looked down on them from above to see a pink shape silhouetted against the turquoise,” he said.

“Approaching the island, the coast was only interrupted by the darker shapes of the town emerging from the beach.”

For the small but fast-growing community here at the time, the daily arrivals were something of a social occasion. “Everyone used to go up to the landing strip,” said David Riley, a UK resident who lived here in the 1960s. “There’d be mail on it, newspapers, food and you’d see who was coming in because there was a constant stream of businesspeople.”

By the late 1960s it was clear a new airport was needed. The strip could become waterlogged and night flights were largely impossible. It also could not cope with the influx of people arriving on the back of the oil boom.

Al Bateen Airport, close to the Maqta Bridge, opened a few years after the older photograph was taken. It had a striking modern concrete terminal and gave its name to Airport Road (now Sheikh Rashid bin Saeed Street), which for many years was the only motorway out of the city.

But even Al Bateen couldn’t cope with the surge of executives, oilmen and others flying into the fast-expanding city. Something had to be done.

Abu Dhabi International opened on January 1, 1982. The airport, designed by famed French architect Paul Andreu, championed travel. The distances between gates were short. Planes stopped around circular satellites so they could fill up and leave quickly. Its main terminal – now Terminal 1 – was an architectural beauty with a stunning mosaic ceiling, reminiscent of a palm tree, that is covered in lime-green and blue tiles.

Abu Dhabi Airport has since been expanded, while the UAE’s national airline – Etihad – was launched in 2003.

The old control building, meanwhile, is still standing today in the grounds of the Abu Dhabi Media building in the city – off Sultan bin Zayed the First (Muroor Road) and 17th Street today. It is being preserved for future generations and is a reminder of the dizzying journey the emirate has been on since those early years.