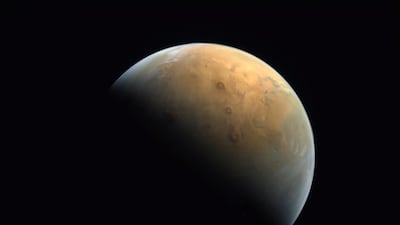

A simulation of the UAE’s planned settlement on Mars is to be built in the metaverse.

The Mohammed bin Rashid Space Centre is helping Bedu, a Web3 technologies company in Dubai, design the simulation.

The UAE aims to build a settlement on the Red Planet by 2117, but the primary goal of the project is to help create jobs in the country and inspire more youth into science, technology, engineering and maths careers.

The space centre will share data and information on space and Mars to help create the simulation.

“As we set our sights on ever more challenging destinations for exploration with humans and robots, innovative ideas and future thinking will be critical to helping us reach new milestones,” said Adnan Al Rais, manager of the Mars 2117 programme.

“Concepts like this will be supported by Mbrsc as we believe this will help us expand our scope of bigger possibilities.”

The space centre is also building the Mars Science City, a research facility in Dubai.

The Dh500 million project will enable research on the Red Planet and help carry out analogue mission — field tests that replicate deep-space travel.

Amin Al Zarouni, chief executive of Bedu, said that the UAE was leading the way in space.

“We are excited to partner with Mbrsc and are honoured to capture this spellbinding adventure to the stars using the power of the latest and greatest technologies here on Earth,” he said.

“With 2117 we aspire to deliver a fully experience driven metaverse that focuses on creating endless opportunities for both, individuals and organisations.”

The space centre is a supporter of international efforts to send astronauts to the Moon and then onwards to Mars.

It is already taking part in analogue missions to help scientists with research, including the psychological and physiological effects on humans of long-duration flights.

Saleh Al Ameri, an Emirati mechanical engineer, was the first Arab analogue astronaut.

He spent eight months inside a Russian analogue facility with five other crew.

The experiments were part of a five-year research programme by Russia’s Institute of Biomedical Problems and Nasa’s Human Research Programme.

Analogue facilities in the UAE would give Emirati volunteers easier access to training in such environments.

A timeline for the completion of the Mars 2117 simulation in the metaverse was not revealed.