More than 1.3 million meals were distributed to low-income workers in Dubai in one week, under the emirate's 10 Million Meals initiative.

An average of 300,000 meals are delivered each day by volunteers who are taking part in the UAE's biggest food distribution drive to date.

The initiative aims to help people who would have relied on mosques for food during Ramadan. It was launched by Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai, last month.

Mosques have remained closed to prevent the spread of Covid-19.

The campaign is led by Sheikha Hind bint Maktoum, wife of Sheikh Mohammed, and is overseen by Mohammed bin Rashid Al Maktoum Global Initiatives.

Sara Al Nuaimi, director at Global Initiatives, said: "The meals are delivered to labour accommodation, as well as individuals and families affected by the Covid-19 outbreak, to whom they are sent door-to-door."

Last week, it was revealed that contributions from companies and the public had already paid for 11 million meals, more than the original target.

That included individual cash donations via SMS and a flurry of cash pledges from public and private sector companies.

Every meal weighs about 600 grams and includes a serving of rice, chicken, three dates, a piece of fruit, a 500ml bottle of water, and a carton of Laban Up.

The National visited one of the restaurants in Dubai where the food was being prepared for delivery on Friday.

A team of 30 people prepare 1,000 meals each day at Al Nadeg Restaurant in Dubai.

For safety reasons, the number of people working at each restaurant is kept at a minimum.

Food is being prepared every day at several restaurants across the emirates. The meals are then packaged up and sent out to those in need.

"During the first week of the campaign, we were able to deliver a total of 1.3 million meals and 10,000 food packages," said Ms Al Nuaimi.

"There are five volunteers from Beit Al Khair Society to oversee preparations and distribution. But there are many more volunteers supporting the campaign whether in the kitchens, packaging, and distribution."

The meals and food packages are distributed at labour accommodation and handed out to low-income individuals and families.

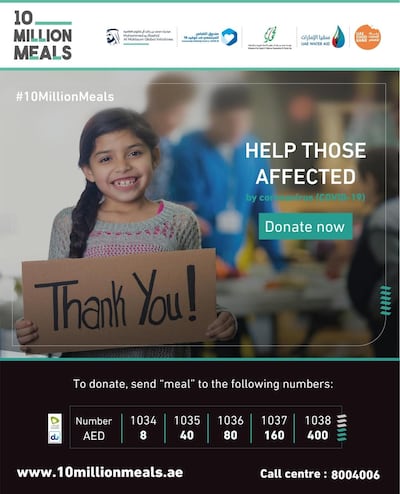

Companies, institutions and the public can contribute money to help the cause. Donations start from Dh8.

How to donate:

Donors can visit 10millionmeals.ae to buy a number of meals to be distributed.

The money for the cause can be transferred online or through a text message.

For in-kind donations of food supplies, parcels or other services, people can contact toll free 800 4006.