Visitors to the 41st Sharjah International Book Fair (SIBF) will enjoy centuries-old Arabic and Islamic books, some dating to the 1200s, as they go on show in the Gulf for the first time.

The works will be shown at a special exhibition during the 12-day event in collaboration with Italy's Catholic University of the Sacred Heart and Ambrosian Library.

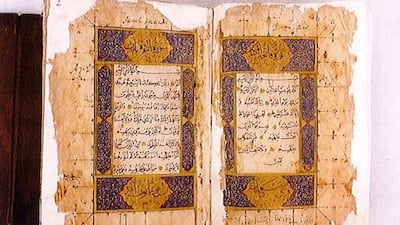

Included in the display will be embossed and gilded pages copied from the Quran that date to 15th and 16th centuries and a 17th century cosmology manuscript titled ‘Miracles of Existence’.

There will also be a rare genealogy manuscript featuring the family tree of the Prophet Mohammed.

Another work on display is part of Firuzabadi’s Al Qamus Al Muhit — one of the most acclaimed Arabic dictionaries from the 14th century.

A 13th century manuscript by Makki bin Abi Talib Al Quaisi on the sciences of the Quran titled Uncovering The Faces of The Seven Readings is the oldest manuscript at the exhibition.

Published in 1753, François Ogier’s book titled The History of Arabs under Caliphates is also available for historians to explore, as is Antonio de Sgobbis’ Nuovo et Universale Teatro Farmaceutico (New Universal Pharmaceutical Book), published in Venice in 1667, which features pharmaceutical practices and ideas from ancient Arab medical heritage influenced by Greek physician Galenus.

The fair will also display Greek historian Herodotus’ book titled Historical Deeds of the Greeks and Barbarians Through the Life of Homer. It features 10 maps and extensive notes, one of which is a map of ancient Egypt.

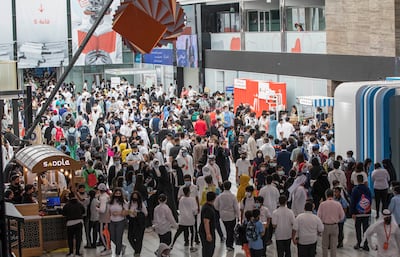

The 41st annual event will take place between November 2 and 13 at the Expo Centre Sharjah with the theme Spread the Word.

More than 120 cultural figures will be featured in the fair, including Moroccan poet and former minister of culture and communication Mohammed Al Ashari, Egyptian author Ahmed Mourad, as well as Emirati writers Sultan Al Amimi, Khulood Al Mualla, Ibrahim Al Hashemi and Asma Al Hammadi.