DUBAI // An Egyptian lawyer has filed a civil suit seeking to overturn a year-old ban on non-Emirati lawyers practising in Dubai courts. The lawyer, Hamdi al Shiwi, filed the suit yesterday claiming that the administrative order contradicts the decrees and laws already established to protect lawyers. The order was made on October 29 of last year by the the Director General of Dubai Courts.

It stipulated that non-Emirati lawyers would not be allowed to argue cases in the Dubai Cassation Courts or the Dubai Courts of Appeal from January 1 of this year. It also stated that from March 31, 2012, non-Emirati lawyers would be barred from deliberating in any Dubai Court. In 1996, the federal Government issued a law barring non-Emirati lawyers from practising at federal courts. Dubai, however, has its own court system and issued its own law allowing non-Emirati lawyers to practise in Dubai.

In his claim, Mr al Shiwi states that an administrative order should not be able to cancel out a Dubai law that allows Arab lawyers to practise. He argues that any such order would have to be issued by ministerial or royal decree to be valid. Furthermore, he says that when the federal law was announced in 1997 it granted an 11-year grace period before its implementation in 2008. "How is it possible for an administrative order to be issued and provide such a short grace period between October 2008 and January 2009?" he asked in his claim.

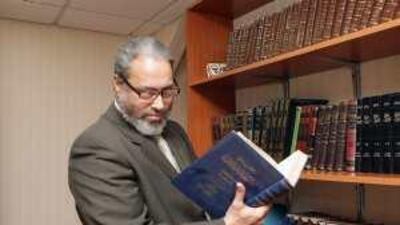

"This administrative order has not only affected my business but has affected people's interests. People stopped dealing with my firm since the order came out, and I am speaking about clients that have dealt with me for the past 18 years." Mr al Shiwi came to the UAE in 1989 as a judge in Umm al Qaiwain courts. He opened his firm in Dubai 18 years ago, after he gained a special permission from Sheikh Mohammed bin Rashid, Vice President of the UAE and Ruler of Dubai and has built a life in the emirate.

He has two sons living in Dubai who now also practise law here. He said the change in law had had a dramatic impact on his practice. "The order's effect on business has been immense," he said. "If I take a case to the lower courts and deliberate, I cannot continue to work on it when it gets to the higher courts now." He said he is the youngest of five non-Emirati lawyers at his firm still practising law.

Mr al Shiwi, who is in his late 50s, said: "If they just let things flow organically, we would be out of the picture within the next few years." Prominent Emirati lawyers have stated that the decision was made to boost the number of Emirati lawyers. "When the federal law implementation was postponed, this was due to the low number of Emirati lawyers in the UAE," said one of them, Salem Salem al Sha'ali.

"This is something that is practised in all the Arab countries where local lawyers are only allowed to deliberate." Another lawyer said there were 800 to 900 federally licensed lawyers along with 600 to 700 locally licensed lawyers in Dubai. "In 2001 there were very few Emirati lawyers, but now the market is abundant with them," he said. The lawyer, who did not wish to be named, said Emirati lawyers were necessary to protect individual rights. "We need to have Emirati lawyers who know the UAE law and possibly can effect political change when it comes to legislation."

Furthermore, he said, the move to bar non-Emirati lawyers protects the competitiveness of the market by disallowing international law firms to enter. "A lawyer's reputation depends on his track record and the size of his firm," he said, explaining that when large international firms come to the UAE clients would be more inclined to go to them rather than taking a chance on a local firms that may not be as experienced.

amustafa@thenational.ae