ABU DHABI // Dubai World Corporation and its subsidiaries Nakheel, Exomos and Palm Marine are suing a former employee, alleging the Frenchman orchestrated a "sinister plan" and cheated the company out of more than US$31 million (Dh114m) after he was hired to build luxury submarines that were allegedly faulty. The complaint, which accuses Hervé Jaubert of breach of contract, fraud, breach of fiduciary duty, conversion and conspiracy to commit fraud, was filed on Monday with the US District Court in Florida.

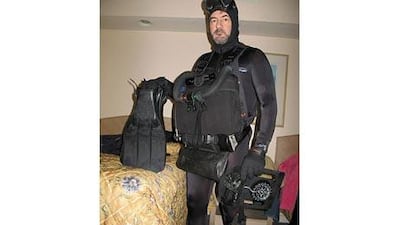

Mr Jaubert, who now resides in Florida but is not a US citizen, denies the charges. He fled the UAE in May 2008. He claims to be a former French spy, and says he used some of those skills to reach India. "[Mr Jaubert] is claiming he couldn't get a fair hearing in Dubai, which frankly I dispute," said George Dalton, the general counsel for Dubai World, "So we're saying, 'If you don't want to come to Dubai and face up to what you've done ... we'll come to your home court in Florida, where you live, and play the game with you.'

"I'm quite confident that the US court will vindicate the decision of the Dubai court and find that he defrauded us." In April, Mr Jaubert, 53, was convicted in absentia by a Dubai court for defrauding the company of $3.85m. He was sentenced to five years in prison. Contacted yesterday in Florida, Mr Jaubert said he was not aware of the lawsuit, but was not concerned. "I just heard that now and it's all false," he said. "I expected this. I'm absolutely not worried because I have all my bank statements and I can prove it's not true."

Mr Jaubert said he believes Monday's suit was a reaction from Dubai World after he sued the company on September 9 for abuse of process, false imprisonment, fraud and defamation. "It's their response to my lawsuit. There is no 'sinister plan', nothing premeditated. They came to Florida [for recruitment]; I did not look for them." Mr Jaubert, who says he is a former French naval officer, was recruited in 2004 to become the chief executive officer of Exomos, a subsidiary of Dubai World created to manufacture recreational submarines. He says he signed a contract with the company in July 2005.

According to the court complaint, he hatched a "sinister plan" in which he "siphoned money from Plaintiffs Exomos, Palm Marine and Dubai World" through his own company, Seahorse Submarines. Through early 2006, the complaint states, Mr Jaubert caused Exomos to purchase "unnecessary" materials from Seahorse for more than US$3m. "Defendants Jaubert and Seahorse secretly added an undisclosed markup of 10 per cent on all purchased materials," the complaint alleges.

Mr Dalton said none of the three submarines ordered by Nakheel and Palm Marine were functioning. Deposits on the purchases, worth $57,000, were never returned by Seahorse, the complaint states. "I believe that [Mr Jaubert] is a con man and took advantage of some boom times in Dubai," said Mr Dalton, speaking by phone from the US. "I think he told a very good story, he had some submarines that looked real pretty and went down real well, but coming up they were a real problem.

"There were an awful lot of engineering aspects in the submarine that were simply poorly designed, poorly thought out and dangerous." Mr Jaubert acknowledged that two submarines he delivered in 2004 were not fully operational, but he said he could prove the receiving parties knew that in advance. "In 2004 south Florida was hit by two hurricanes ... so I could not deliver two submarines at the time," he said. "They told me to ship them as is ... so when the submarines were delivered, of course they could not work."

Mr Jaubert has written a book about what he claims to be the "true" account of how he escaped from Dubai using disguises, aliases, cunning and a rubber dinghy. He said he hopes the book, to be released next month, will clear his name.

Asked if Mr Jaubert could be extradited to the UAE, Mr Dalton said it was possible but the process could take years.

mkwong@thenational.ae