The only constant is change

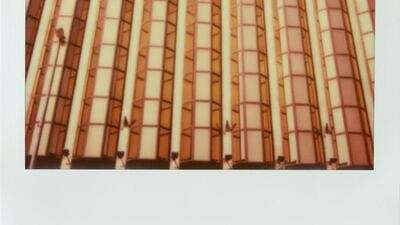

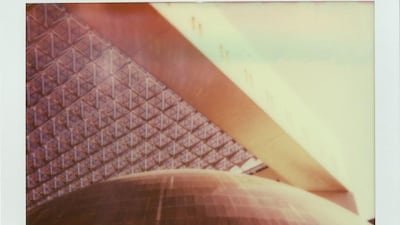

Hind Mezaina’s Polaroids, taken in Deira, Dubai, take deeper meaning as the neighbourhood is slowly redeveloped, Nick Leech writes

Unlike Polaroid images, which appear almost immediately, the development of photographic projects can often take some time.Hind Mezaina started taking her Deira Polaroids motivated, in part, by a desire to create an ode to a neighbourhood she associated with her childhood and with the very essence of Dubai.

“To me, Deira is Dubai,” says Mezaina, 43, a photographer, writer and blogger. “It’s the Dubai I know and remember and it occupies a special place in my heart.

“I experienced it when I was growing up, when I used to go to the souq with my mother and we would visit family and friends.

“Despite all the changes in Dubai, it always seemed to be the place that was constant – but even that now seems to be changing.”

In the past six months, Mezaina has noticed an increasing number of empty buildings in the neighbourhood, which look as if they are “hollowed-out and ready to go”. Now the rate of change in the area seems to have reached a tipping point. Yesterday, Dubai’s dhow operators received news of a plan that could lead to them moving from their traditional moorings near Deira’s historic spice souq to a location opposite Deira Islands, along the new Deira Corniche.

The Dhow Wharfage Development Project is 3 kilometres long, will increase the annual capacity for cargo handling on the Creek to an estimated 1.7 million tonnes and will allow more than 400 dhows to dock at any one time. The scheme was announced in 2012 but a section recently opened opposite the Hyatt Regency hotel, and several boats have vacated the moorings where dhows have docked for more than a century. For Mezaina, the news not only raises important questions about the future of Deira but it also places her project in a very different context.

“What will Deira represent in the future?” the photographer asks. “Does this mean that Deira is going to turn into a new Dubai Marina? The Deira Polaroids feel like a far more urgent project now.”

Mezaina first exhibited her Deira Polaroids in March at the Sikka Art Fair, which was held in the Al Fahidi neighbourhood in Bur Dubai. At the time, the images communicated a very different set of messages. Mezaina’s use of a Polaroid camera and her choice of subject matter, including the 1963 Deira Clocktower, confused many visitors.

“When people look at certain parts of Dubai they immediately associate it with the past and don’t even think about it in the present,” she explains.

“Not many realised that the pictures were taken just a month before the exhibition. When I started to hear those conversations, I was quite intrigued by that ... It would be easy to draw the conclusion that these pictures are nostalgic because I am revisiting places that I remember from my childhood, but these photographs are about the present and places that are still here.”

The Deira Polaroids raise questions about the relationship between Dubai’s urban present and the value and conservation of its past in a part of the city where issues of heritage, integrity and authenticity were recently the focus for debate. In June, Dubai Creek’s bid to become a Unesco World Heritage Site was deferred pending a visit from the International Council on Monuments and Sites (ICOMOS) and the submission of further documents relating to the area’s urban fabric. In its report to the 38th ordinary session of the World Heritage Committee held in Doha in June, ICOMOS said: “Khor Dubai’s capacity to symbolise or represent an outstanding example of urban and residential development is rather limited as a result of its significant reduction of historic architectural substance and urban patterns as well as changes of the shape of the mouth of the creek ... The neighbourhoods were partly demolished and reconstructed and in other cases extensively restored and now provide an impressive imagination of what the city may have looked like half a century ago.”

Mezaina’s Polaroids share the same qualities as the neighbourhood they describe. It is a world where the status of the past, present and the future is far from certain and each is a matter for debate.