The oldest pearling town in the Arabian Gulf has been discovered in Umm Al Quwain.

Announcing the major find on Monday, the Umm Al Quwain Department of Tourism and Archaeology said digs at the site this year have yielded evidence of a thriving more than 1,300-year-old settlement that predates the rise of Islam — with hundreds of houses and several thousand people.

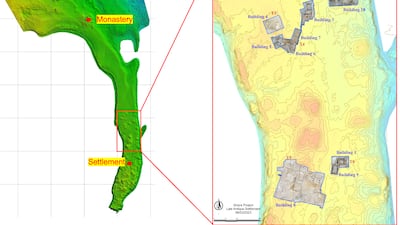

The landmark discovery was made on Al Sinniyah Island, close to the ancient monastery found last year, and it is now believed the monks made their home next to this major pearling settlement.

It sheds light on the harsh life of the pearl trade, how these early communities were plugged into global trade networks and poses questions as to why monks chose to set up their monastery so close.

United Arab Emirates University

“This is a discovery of major significance for the history of Umm Al Quwain, the UAE and the wider Arabian Gulf,” said Sheikh Majid bin Saud Al Mualla, chairman of the emirate’s Department of Tourism and Archaeology.

“Pearling has been an essential part of our livelihood and our heritage for over 7,000 years, and some of the earliest known evidence of pearling comes from Neolithic graves in Umm Al Quwain,” said Sheikh Majid.

“For the first time, we have the opportunity to study a pearling town from over 1,300 years ago.”

Although other pearling towns of this period are known from historical sources to have existed in the Arabian Gulf, this is the first time the site of one has been investigated, documented and excavated.

One reason is because the town's inhabitants left the island and the site was never reoccupied, ensuring it remained preserved.

“We originally thought it was a village to serve the monks,” said Prof Tim Power of the UAE University, who was part of the team that discovered the site. “But it was clearly much more.”

Digs carried out this winter showed how something special had been unearthed.

As they went down through the layers, archaeologists found palatial dwellings with large courtyards where it is thought wealthy pearl merchants and elite members of society lived.

Surrounding these were smaller houses believed to be the homes of poorer fishermen.

Rich and poor lived side by side and traded with countries across the globe with the town's focus overwhelmingly on pearling during about 200 years of occupation.

“It was a town like the coal mining towns of the Welsh valleys or Detroit’s car industry,” said Prof Power. “It was big and important," adding it was the spiritual ancestor of pearling towns such as Dubai and Ras Al Khaimah's Jazirah Al Hamra.

These homes were built from local beach rock, while the roofs were likely made from palm trunks brought from the mainland.

Several pearls were found, together with a pearl diver’s weight — devices worn by divers to allow them to descend — which is the oldest well-dated instance yet found in the UAE.

Thriving trade

Inside the merchant homes were supplies to sustain the thriving pearl trade, such as bales of rope. “They are very large courtyard houses and similar to those found across the Arabian Peninsula,” said Prof Power. “Families live together, reflecting the Arab way of life.”

The shallow, warm waters of the Gulf were known to produce some of the world’s most prized pearls. It brought trade and wealth but pearl diving was a tough life and divers risked death.

Underlying the tough, back-breaking work of the pearl industry, a huge mound of opened and discarded oyster shells — essentially the industrial waste of the pearl industry — was discovered on a peninsula opposite the town. Archaeologists believe millions of shells could have been discarded here over the 200 years the site was occupied with thousands opened to find one pearl.

The town also traded with the Gulf and beyond. It is densely covered in pottery, glass and coins. Evidence for particularly close links to India was found where it is believed pearls were traded for goods.

“Twelve per cent of ceramics found there had been imported from India,” said Prof Power. "That is exceptionally high.”

Radio carbon and comparisons of the pottery sherds dated the site to the late sixth or early seventh to mid-eighth centuries, beginning around a generation before the rise of Islam and lasting for perhaps two generations after the arrival of Islam in the Emirates. Questions surround its demise. One reason given is regional tensions but more research is needed.

It was likely abandoned in the mid-eighth century and its trajectory roughly follows that of the monastery. The presence of the monks speaks to a time when Christianity and Islam coexisted.

While further investigation is needed to determine the exact relationship between the two, it is clear why the location was chosen. Al Sinniyah, shaped like several fingers, protects the mangrove-fringed Khor Al Beida lagoon. Today it seems remote. Driving across rutted tracks to reach the settlement, gazelles run for cover, while falcons perch on trees. But it is thought people made their home here because of the easy availability of food such as birds and fish. “It was a good place to be to catch your dinner,” said Prof Power.

It was also close to the pearl beds, the lagoon was sheltered and made for a good natural harbour and it was a source of beach rock. Beach rock — stabilised sand — is a naturally forming rock occurring in lagoons. Fresh water springs were also believed to be in the vicinity and residents may have even planted palm trees.

The 12-hectare town — about the size of 12 football pitches — is now believed to be one of the largest surviving urbanised settlements comparable to the urban core of medieval Julfar in Ras Al Khaimah. The scale of the settlement is impressive there are even the remains of tandour ovens where residents cooked food.

The pearling town and monastery were found under the Al Sinniyah Island Archaeology Project, involving the Umm Al Quwain Department of Tourism and Archaeology; UAE Ministry of Culture and Youth; UAE University; the Italian Archaeological Mission in Umm Al Quwain; and the Institute for the Study of the Ancient World at New York University.

Further work is expected at the site and there are also plans to build a visitor’s centre and open it to the public.

“It is the highlight of my career,” said Prof Power. “And one of the most exciting sites I’ve ever worked on.”