An Etihad Airways flight to Madrid had to return to Abu Dhabi after a technical problem on Tuesday.

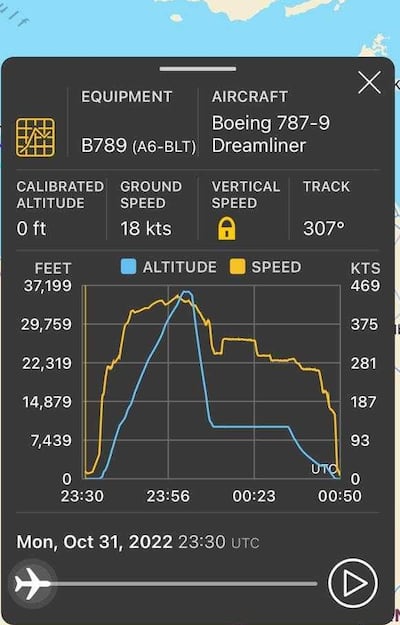

EY075 was near Doha when its crew “squawked” 7700 on the radio — indicating a general emergency — and returned to the UAE capital shortly after take-off at 3.10am GST.

Tracking site Flight Radar24 showed the Dreamliner had rapidly descended to 10,000 feet but no more details were given.

“Etihad Airways flight EY075 from Abu Dhabi (AUH) to Madrid (MAD) on November 1 returned to Abu Dhabi shortly after take-off due to a technical issue,” Etihad told The National.

“The aircraft performed a normal landing at Abu Dhabi and guests returned to the terminal.”

Sudden drops in altitude are not common in aviation.

In the case of cabin depressurisation, flight crew are trained to descend immediately to an altitude where it is possible to breathe without additional oxygen, often around 10,000 feet, and as long as surrounding terrain allows.

Etihad said that passengers will continue their journey to Madrid on Tuesday morning on a different aircraft.

Flight tracking data shows that the flight departed again at 9.03am GST and was expected to land in Madrid at 1.53pm.