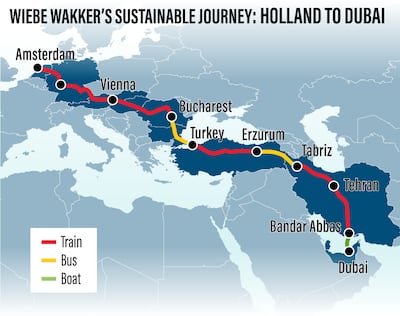

A Dutch traveller hoping to travel to Dubai from Amsterdam by using public ground transport alone was forced to change his plans after hitting problems at the Iranian border.

Wiebe Wakker, 35, made it as far as Erbil in northern Iraq before giving up on his attempt to travel to the UAE by rail, bus, and car to highlight sustainability issues.

Iran’s borders have been closed to all but cargo transport since December 25 but had been due to reopen on January 9.

When that did not happen, Mr Wakker was forced to rethink his plans and took a flight from Erbil to Amman instead.

From there, he will continue his journey overland to make it in time to speak at the World Future Energy Summit as part of Abu Dhabi Sustainability Week on January 18.

“I started the day with a visit to the hospital to take a PCR test for Jordan,” Mr Wakker said in his social media blog on January 9.

“Although it was my plan B, I hadn’t done any research about the countries on this (new) route.

“I’ve been having a good time discovering Erbil’s culture and the city itself.

“My trip is so amazing. I unexpectedly end up in the most beautiful and interesting places.

“A lot of people came to ask me where I'm from and what I'm doing."

It was the second enforced change of plan, after his proposed talk at the Netherlands pavilion at Expo 2020 Dubai had also been cancelled owing to Covid-19.

The self-styled sustainable adventurer, who travelled more than 100,000 kilometres to Sydney from Amsterdam by electric vehicle in 2016, realised his plans would change when he arrived in Dogubeyazit, eastern Turkey.

He was due to enter Iran and head for Tabriz before taking the train to Tehran, and then across the country to Bandar Abbas before catching a ferry to Dubai.

Making it within just 34km of the Iranian border during a global pandemic when many countries were imposing new travel restrictions was a feat in itself.

His route will now take him through Jordan and Saudi Arabia before arriving to the UAE.

“I was a bit nervous going into Kurdish Iraq because of the stories you hear, but quickly felt calm and free,” Mr Wakker said.

“I wanted to keep travelling to the UAE by land, but I was unable to go through Syria or Iraq.

“The only way to continue was to fly over it, so I chose the shortest air route.”