India's new ambassador to the UAE, Sunjay Sudhir, has officially started his role.

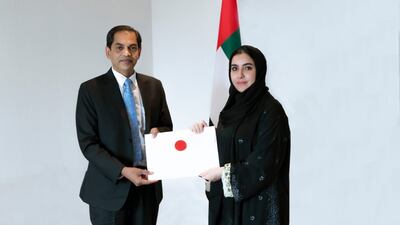

Mr Sudhir presented his credentials to Alya Almehrezi, assistant undersecretary for the Protocols Affairs Office at the Ministry of Foreign Affairs and International Co-operation, state news agency Wam reported on Wednesday.

Ms Almehrezi wished the ambassador success in the role and in enhancing ties between the UAE and India.

The new envoy has served in India's foreign service for decades and replaces Pavan Kapoor.

Mr Sudhir's post before the UAE was as ambassador to Maldives.