One of the world’s leading specialists in private jet designs has unveiled new plans for a VIP, multimillion dollar uber-luxury aircraft.

Lufthansa Technik’s Explorer concept for the Airbus A330 comes with virtual ceilings, an open-air sun deck, a fitness suite and even a dance floor on board.

Click through the gallery above for more images of the 'flying hotel'.

The jet, which premiered at the Dubai Airshow this month, is set to appeal to the world’s super-rich, who like the idea of flying around the globe in a customised airborne suite.

"Your personal 'flying hotel' will provide you with all comforts and amenities that you can expect from a five-star hotel on the ground,” said a statement from the German private jet fit-out specialists.

The jet was inspired by the idea of the super-yacht, which lets owners travel around the world in what is essentially their own hotel. Lufthansa Technik's specialists have built on this concept, giving passengers the added advantage of being able to travel to the other side of the globe within hours, and then use the jet as a base camp for further activities.

And the futuristic designs for this wide-body aircraft really do seem to ensure that those travellers flying on it will want for nothing.

The jet becomes travellers' own 'base camp'

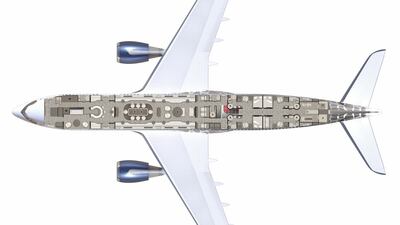

There’s a sprawling lounge area, a conference area, three spacious bedrooms with double beds, a fully stocked bar, a fitness suite and medical room, and a garage located below the main deck.

One of the most exciting elements of the concept is the open-air sun deck. Using the main deck cargo door and the floor at the front of the fuselage, designers have created a retractable veranda that extends outwards to create a terrace that sits some four metres above the tarmac, offering travellers a place to dine al fresco, sunbathe or simply take in the surrounding views.

Virtual ceilings: from boardroom to dance floor

The jet also uses virtual ceilings for a fully customisable ambience that can be changed to suit the traveller's mood or the occasion.

Using technology from Diehl Aviation, the aircraft’s cabin can be changed to create different zones. Projected images, patterns and moving pictures allow for the projection of a calming atmosphere in the medical suite, a neutral vibe during conference calls or a party-like, disco ball-inspired atmosphere in the lounge after hours.

"We created a unique interior to exploit the full potential of the projection system for private jets. The overall look of a VIP cabin can be changed by a fingertip,” said Michael Bork, aircraft interior architect in VIP and special mission aircraft service at Lufthansa Technik.

The technology can also be used to ‘paint by light’, casting projections of towering city skylines, underwater worlds and starlit skies on to the walls and ceilings of the aircraft cabin.

Fully customisable floor plans

Lufthansa Technik also promises that guests can take all their special equipment with them, "no matter if it is a car, off-road vehicle, wing suite, wine cellar, exploration laboratory or even an emergency medical room – or anything else you might dream of”.

The original designs for the Explorer are based on plans for eight to 12 passengers, but the mammoth cabin size of the A330 twin-engine aircraft means there’s plenty of space for additional lavish cabins if desired.

In its most recent neo configuration, the Airbus A330 has a range of more than 10,000 nautical miles, meaning untapped wanderlust for billionaire travellers.

And while a standard A330 neo costs just shy of $300 million, a custom-fitted Explorer is going to set elite customers back a lot more than that.

For aviation enthusiasts and billionaires who aren't big fans of the A330, there is no need to worry. The cabin floor plan for the Explorer is fully customisable and the designs can be easily transferred to fit any other wide body jet, such as an Airbus A350 or a Boeing 787, said Lufthansa Technik.