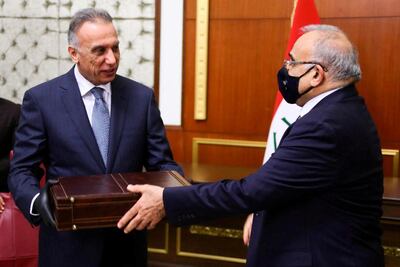

Last Wednesday, Mustafa Al Kadhimi became Iraq’s sixth prime minister since the fall of Saddam Hussein’s regime in 2003. In addition to making history as the first former journalist and head of intelligence to lead the government in Iraq, Mr Al Kadhimi has inherited a historic list of challenges – from fighting a global pandemic with a broken healthcare system to stewarding an economy that is expected to contract by almost 10 per cent with low oil prices.

He faces those challenges, moreover, having been able to pass only 15 of his cabinet picks, leaving critical posts like Oil Minister and Justice Minister vacant.

A scan of the resumes of those who did make it into the cabinet shows a competent and largely apolitical group. Several ministers, such as those responsible for electricity and health, have been working in their portfolios for decades, ensuring they are familiar with the actual problems they are now mandated to fix.

Mr Al Kadhimi has also brought in effective ministers for defence and interior, each of whom has a track record in the security sector, affording a greater chance of reining in some of the militias operating in the country.

However, the prime minister’s opponents both within Parliament and outside it, primarily those fearing that their vested interests are under threat, will make his government’s job much harder than it already is. A standoff is inevitable, but how it will play out remains to be seen.

In under a week, Mr Al Kadhimi has taken a number of significant steps to demonstrate a seriousness and resolve that have been missing from Iraqi governments for years. His decision to reinstate counter-terrorism commander Abdul Wahab Al Saadi was vital both in the fight against ISIS and in heeding the calls of protesters.

Furthermore, his announcement of a thorough investigation into the killing of hundreds of protesters is important, but only if there is real follow-through. The announcement preceded a dawn raid on the Basrah offices of Thar Allah, a militant group, after evidence showed it was behind a number of attacks against protesters.

Mr Al Kadhimi’s first formal outing after being sworn in was to the state pensions authority. His choice to visit one of the most bureaucratic and cumbersome institutions in Iraq is a testament to his knowledge of the concerns of ordinary Iraqis.

While young people are on the streets demanding jobs, some of those who have served Iraq for decades have not been paid for months. Reversing an earlier decision to freeze pension payments, Mr Al Kadhimi said he was committed to securing their rights. The prime minister will need to continue building such popular support in addition to a strong political coalition in order to overcome the challenges ahead.

News reports have insinuated that Mr Al Kadhimi was only able to secure power after an endorsement from Hezbollah in Lebanon. Such reports are false. Meanwhile, Hezbollah affiliates in Iraq and Iranian-backed Shia politicians have been briefing journalists that Tehran is the kingmaker of Mr Al Kadhimi’s government. In reality, however, Iran’s acceptance of this government and that of its Iraqi allies only came as they ran out of other options.

Another voice that has been absent from the public political jostling thus far is that of the Shiite leader in Iraq, Ayatollah Ali Al Sistani. Since the Covid-19 outbreak, Mr Al Sistani has kept his doors both figuratively and physically shut. His clients, too, were forced to compromise and allow Mr Al Kadhimi’s government to form, as economic woes and fragmentation amongst Iranian-backed groups set in.

While there is much international interest in how Mr Al Kadhimi will balance relations with Iran and the United States and what his foreign policy will look like, the success or failure of his tenure will depend much more on internal dynamics.

Iran has great influence inside Iraq today, but it largely exerts that influence through local proxies. And while ardent Iran supporters like former Iraqi prime minister Nouri Al Maliki and leader of Asaib Ahl Al Haq Qais Al Khazali, have declared their opposition to Mr Al Kadhimi, others from Iranian-backed groups are manoeuvring to secure their interests and avoid a direct confrontation. Some may bide their time, hoping that the prime minister’s tenure is short. Elections are expected to take place within the next 18 months. A lot can happen in 18 months, but not enough to turn Iraq around.

Having no political party and having never run for office, it is not yet clear if Mr Al Kadhimi will run in the next elections. He has little time to implement his ambitious reform programme and many grievances to deal with.

On Saturday, as Iraqis were sharing news of the decisions that came out of the new prime minister’s first cabinet meeting, a solemn announcement was made. Princess Badiya bint Ali, aunt to the former monarch, King Faisal II, passed away in London at the age of 100. She was the last living link to Iraq’s monarchy and an era filled with promise for what the future could bring.

Mr Al Kadhimi expressed his own sorrow at Princess Badiya’s death in a tweet: ‘With the passing of Princess Badiya bint Ali, a bright and important chapter of Iraq’s modern history ends. She was part of a political and societal era that represented Iraq in the best of ways’.

Here is hoping that Mr Al Kadhimi can begin a new chapter – one that represents Iraq in the best of ways after years of the worst.

Mina Al-Oraibi is editor-in-chief at The National