The wildfires currently rolling through southern California have brought unprecedented damage to the Golden State and dominated global headlines. Thousands of miles away from the US, in Iran, the wildfires have become the subject of a revealing political debate between the country’s divergent political factions. It can be seen as a dress rehearsal for much larger political battles that are bound to rock Tehran in the Trump era.

The reformist government of President Masoud Pezeshkian barely hides its desire to engage with the United States in the hope of reducing tensions. Ali Abdolalizadeh, Mr Pezeshkian's maritime development envoy, recently even claimed that Tehran was happy to directly negotiate with the US and that a deal could be made in two to three months. Iran was hopeful for US investment, particularly in the oil and gas sector, Mr Abdolalizadeh added, engaging in a bit of fantasy. But real power continues to lie not with Mr Pezeshkian but with the Supreme Leader Ayatollah Ali Khamenei, who continues to vocally oppose normalisation of ties with the US. He recently asked Mr Pezeshkian and his government to “avoid considering the demands of US and Israel".

Avoiding a direct confrontation, Mr Pezeshkian and his allies seem to subtly use every opportunity to show an alternative approach to the leader’s anti-Americanism. In response to the wildfires in Los Angeles, they have engaged in humanitarian diplomacy, trying to offer solidarity and even offers of aid.

On January 11, Mr Pezeshkian’s spokeswoman, Fatemeh Mohajerani, expressed the government’s “sympathies with the people of California”. Vice-President Mohammadreza Aref joined her by offering “sympathy” and “prayers for quick improvement for all those affected”. The head of Iran’s Red Crescent Society Pirhosein Kolivand went a mile further in a message to his American counterpart, who heads the US Red Cross. Iran was ready to send “aid equipment and dedicated personnel,” Mr Kolivand said. “You are not alone,” he added, addressing Americans.

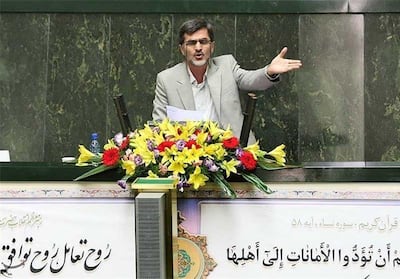

This was all a bit much for Mehdi Kouchakzadeh, a hardliner MP from Tehran. In an outburst in the Parliament on January 13, Mr Kouchakzadeh attacked Mr Abdolalizadeh. “Someone has to smack him in the mouth,” Mr Kouchakzadeh said in response to Mr Abdolalizadeh’s stated desire of negotiating with the US. He also attacked Mr Pezeshkian’s Vice-President for Strategic Affairs Javad Zarif, a US-educated diplomat and former foreign minister.

But Mr Kouchakzadeh reserved most of his ire for those who had suggested helping the LA fire victims.

Using non-parliamentary language, Mr Kouchakzadeh said that as an Iranian taxpayer, he wouldn't consent to one cent of his taxes going to Los Angeles before it’s spent on Gaza.

The hardliner MP is not alone. Some pro-regime Iranian outlets have been running appalling coverage of the American wildfires. The Americans were receiving “God’s fury,” a news agency wrote. Hardliner daily Kayhan invoked a Karma-like Islamic concept to claim that the US was suffering from the fires because it was paying for its sins towards “Gaza’s innocent children and Palestinian mothers”. Even Ali Motahhari, a former conservative MP, said the fires were “a warning from the divine world to the US government and a majority of the American people”.

But Mr Kouchakzadeh’s antics have also led to a lot of opposition. The video of his speech has gone viral leading to many attacks on social media. Many observers have curtly reminded him that if “Iranian taxpayers” were to have a say, they likely wouldn’t have funded Iran’s myriad foreign militias. Others, such as public intellectual Sadeq Zibakalam, pointed out that Mr Kouchakzadeh had been elected by fewer than 400,000 votes in a city of six million eligible voters, so he hardly represented the majority. This is because most reformists and non-hardliners were not allowed to run in the parliamentary elections last year resulting in record-low turn-out, especially in Tehran. The hardliner-dominated Parliament thus suffers from a crisis of legitimacy.

Even some conservatives demurred. Conservative analyst Abbas Salimi Namin criticised the MP for “making human matters into political and factional questions”. There was no contradiction between supporting Palestine and offering sympathy to victims of the LA fires, he added. Many Americans had shown that they opposed their government’s support for Israel, he added. Salimi Namin also pointed out that there has always been a faction in the Islamic Republic that believed in negotiations with the US, formerly headed by Ayatollah Akbar Hashemi Rafsanjani, a former president and a founding father of the regime.

But perhaps the most comprehensive answer to Mr Kouchakzadeh was given by the reformist daily Sharq, which attacked him “as always lowly and angry." It reminded its readers that back in 2003, the US had helped Iran during the devastating earthquake in the city of Bam. The Bush administration had even suspended its sanctions on Iran for three months. Sharq also recounted an episode from those days that many have now forgotten: Hassan Rouhani, then Iran’s national security advisor, visited the field hospitals that Americans had set up in Bam, an encouraging sign of Iranian-American contact at the time when tensions were incredibly high after the Iraq War.

For its part, the government also gave a response. Speaking to the press on January 15, Ms Mohajerani said Iran had not given any help to Angelenos yet but was expressing its readiness to do so since the fires were continuing. “We all have one world and live in the same world,” she added.

No one expects Iran to send any actual aid to California, of course. But the symbolic gesture by the Pezeshkian government is unmistakable, testing the waters of eventual engagement with the US. If the stated desires of US President Donald Trump and many in the Iranian regime come true, such engagement is forthcoming. It will be subject to much louder noise and disagreements, in both Tehran and Washington.