Today the Middle East picture is incomplete, but it's important to take stock of a number of interesting signals from the region. Even as some Arab Gulf states are making ground-breaking moves, the Iranian regime is grappling with the repercussions of its crackdown on popular protests as well as its role in the Ukraine war.

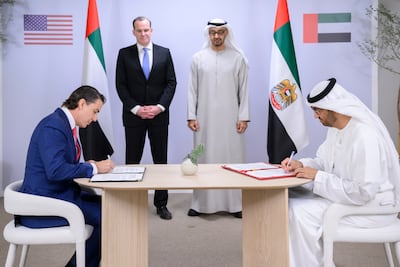

Remarkable developments are indeed taking place in the region – from the various summits in Saudi Arabia, to Pope Francis's historic visit to Bahrain. The UAE has signed a strategic partnership agreement with the US to invest $100 billion to produce clean energy, strengthen energy security, and push for climate action.

But one of the most important developments this week is that the US, Saudi Arabia and other countries put their forces on high alert amid joint intelligence reports indicating that Iran is planning imminent attacks on energy facilities in the region, especially in the kingdom. Commenting on the development, US National Security Council spokesperson John Kirby said: “We are concerned about the threat … we will not hesitate to act in the defence of our interests and partners in the region.”

The Iranian regime is stunned by the uprising against its repression and the moral support Iranian women have received in international forums following the death of Mahsa Amini in September. Washington, meanwhile, is preparing more sanctions against Tehran in retaliation against its arms supply to Russia, including possible measures to intercept these shipments.

However, the Islamic Revolutionary Guard Corps is not panicking. In Iraq, the Iranian regime has secured its interests, including the control of key levers of government. Benjamin Netanyahu's return to power, meanwhile, could improve Israel's relations with Russia owing to his friendship with Vladimir Putin, which in turn could reflect on Iranian-Israeli relations.

Pope Francis's visit to Bahrain to attend an inter-faith conference alongside Dr Ahmed Al Tayeb, the Grand Imam of Al Azhar, is significant. Bahrain is home to the largest Catholic cathedral in the Arabian Gulf region, in the city of Awali, and the pope's visit has highlighted the importance of strengthening Christian relations with the Muslim world – a crucial pursuit in an era in which sectarian tensions and religious extremism are festering around the world.

The separation of religion and state remains one of the biggest challenges in the Middle East, with the Israeli right and the Iranian regime converging on the issue of imposing religion on the state. The recent Israeli election results have confirmed this trend in that country. The Iranian regime, meanwhile, continues to impose a theocracy that has set the nation back by more than half a century.

Mr Netanyahu will pursue more extremist policies against the Palestinians, but he will not be able to fully extricate himself from the commitments of the previous government, such as the agreement demarcating the Israel-Lebanon maritime border. It will also be worth monitoring how Israeli-Russian relations develop, especially in the context of Ukraine and the implications for Russian-Iranian-Israeli relations.

Iran will not be able, nor does it want, to downgrade its strategic relations with Russia. It is aware that its regional role, especially in Syria, is linked to Russia. Iran will not end its involvement in the Ukraine war alongside Russia, even if it were to incur further US sanctions or if its arms supplies were intercepted.

Interestingly, despite the latest round of US-Iran tensions, the Biden administration has yet to say that the deal to revive the Joint Comprehensive Plan of Action is dead. But even in the best-case scenario, the talks are clinically dead and no one dares to breathe life into them now.

The other interesting development is the Saudi and US state of alert triggered by intel indicating Iran is planning an attack on energy facilities in the kingdom, to divert attention away from the regime's domestic troubles. If Tehran risks staging attacks, this would invite a US response – not in the form of war but by way of stronger US-Gulf security ties.

It is clear that the Biden administration has decided to contain any further deterioration in its relations with the Gulf states – which have suffered several shocks for reasons related to energy, arms sales and mutual distrust – especially security relations.

The UAE-US partnership carries plenty of significance, with the two sides stressing that their “close strategic alliance" will contribute to "supporting the transition process in the global energy sector and building a more sustainable future", as US Envoy for Energy Affairs Amos Hochstein said.

Last week, during the Future Investment Initiative conference in Riyadh, it was clear that America's private sector, led by major investment banks, was less interested in the Opec+ crisis involving Saudi Arabia than it was in the strong, historic and strategically important relations between the US and the kingdom. Moreover, the Biden administration has told Saudi officials in its own way that, while a political escalation against the kingdom was necessary amid clamouring in the US Congress for measures against Opec+, there is no real intention to reassess their relationship.

Thus, while US-Gulf strategic co-operation is being strengthened, Iran is reinforcing its strategic alliance with Russia. On the other hand, while Tehran continues its repression of its people, especially women, the Gulf states are pursuing reforms, developing their social infrastructure, opening up, and encouraging inter-faith engagement.

All eyes will now be on Iran to see whether it carries out potential attacks on Saudi Arabia, as has been reported, or whether it is manoeuvring to deliver a message to Washington, hoping that the Biden administration will return to the nuclear talks. I am told that the Iranian regime has supplied advanced drones to the Houthis in Yemen, which could be used for attacking Saudi ports and oil installations.

Iran is betting that the Biden administration won't be able to provide support to Saudi Arabia shortly before the mid-term election, and that its security options are limited and will come late anyway, only after the attacks have occurred. Tehran is also betting that America's preoccupation with the alarming developments on the Korean Peninsula will prevent it from dealing with another crisis at the same time, and therefore won't be able to take action against it.

The Iranian regime wants to deliver a message that it can take revenge if its interests are not respected, those being the revival of the nuclear deal and sanctions relief. But until it can escalate matters, it will continue to be stunned and bogged down, as it fears falling into a strategic panic if things continue along their current trajectory.