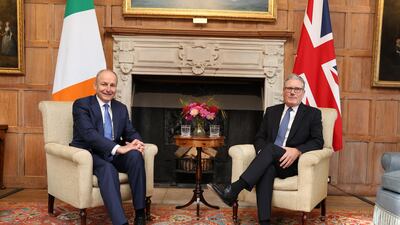

Ireland’s premier Micheal Martin discussed the “intolerable situation in Gaza” with British Prime Minister Keir Starmer on Friday, as the UK prepares to recognise the State of Palestine.

The pair met at the Prime Minister's country home Chequers for a meeting dealing with the legacy of the 30-year conflict in Northern Ireland, but also the UK's bilateral relationship with Ireland.

"The leaders said they were appalled by the strike in Doha this week and the intolerable scenes in Gaza," a Downing Street spokesperson said.

"They agreed it was essential to end the man-made famine, get aid in at scale, release the hostages and find a pathway to a two-state solution to deliver peace for Israelis and Palestinians."

Ireland views the Palestinian issue with sympathy due its historic struggle for independence.

The Dublin government recognised Palestine in May last year, alongside Spain and Norway – defying most other EU countries. It has laid out plans for a trade ban with Israel, which has been met with resistance from EU allies.

This week, the national broadcaster RTE said it would not participate in the Eurovision song contest next year if Israel is involved, after a similar announcement from Slovenia's RTVSLO and followed by the Dutch broadcaster on Friday.

“Ireland was Britain's oldest colony. This has undoubtedly shaped how people from Ireland engage with postcolonial conflicts,” said Jane Ohlmeyer, a professor of modern history at Trinity College Dublin.

Ireland also served as a “template for partition” with the Government of Ireland Act of 1920 later repurposed for the partitioning of Israel and Palestine in 1948 and India and Pakistan in 1947, which leads to further sympathy.

By contrast, the UK has supported Israel’s military campaign in Gaza as well as those in Lebanon, Yemen and Iran. But it became more critical in recent months as the humanitarian crisis escalated and Israel continued to expand its settlement programme in the occupied West Bank.

Britain has since sanctioned two far-right Israeli ministers and violent Jewish settlers, imposed a partial ban on weapons sales to Israel and is set to recognise Palestine at the UN General Assembly later in September.

Both leaders can draw “hope” as well as lessons from the Good Friday Agreement as they continue calling for a peace process, said Prof Ohlmeyer.

“Despite Irish experiences of settler colonialism, the Good Friday Agreement has forged peace on the island of Ireland,” she told The National. “Might this be a ray of hope at an incredibly dark moment, and, in time, provide a template for securing peace in the Middle East?”

Mr Starmer this year tried to champion the Israel-Palestine International Peace Fund, which was modelled on a similar fund for Northern Ireland, but this was dropped after Israel proposed an 80 per cent tax for NGOs receiving foreign aid money.

Ireland prohibits membership or support of organisations such as Hamas and Hezbollah, which are proscribed by the EU and in the UK. The Irish public has been sympathetic to the group Kneecap as the Gaelic-language rappers' lead singer faces charges in a UK court for waving a Hezbollah flag on stage.

There was also a tendency to view the conflict through the "prism" of the Troubles in Northern Ireland, said Prof Ohlmeyer.

"We see this, for example, in the street murals in Belfast, where republican nationalists sympathise with Palestine and loyalists / unionists with Israel," she said. "However this does not necessarily mean that Catholics are anti-Zionists and Protestants anti-Palestinian."

Mr Martin and Mr Starmer also met in March, in Liverpool, in a new series of annual UK-Ireland summits, hailed as the “next chapter” in their relationship after having “turned a page on the turbulent years”.

Speaking before Friday's meeting, Mr Martin said: “I'm looking forward to meeting with Prime Minister Starmer today and to discussing a range of matters, including the progress to date on the delivery of the UK-Ireland 2030 co-operation programme, which we agreed at our summit in March in Liverpool.

“We will also discuss legacy issues, recognising its importance to people in Northern Ireland and across these islands, and to broader British-Irish relations.

“Our discussions will also cover the welcome progress in strengthening EU-UK relations as well as pressing international issues, in particular the intolerable situation in Gaza, and continued support for Ukraine in its defence against ongoing Russian aggression.”