A free trade agreement between Britain and India will be signed on Thursday giving a long-term boost to both countries’ economies amid the global hit of US tariffs.

At stake are significant prizes for the UK, achieving its first major deal following Brexit, and the formerly protectionist Indian economy, as its government lands its first trading pact with a European state.

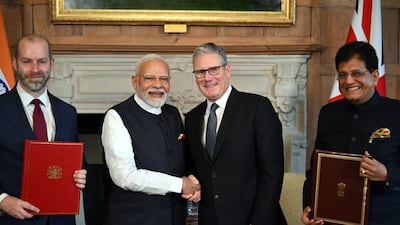

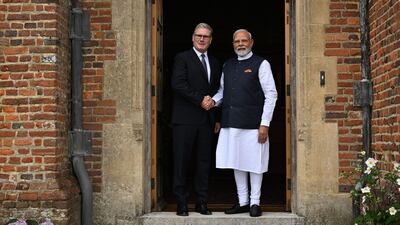

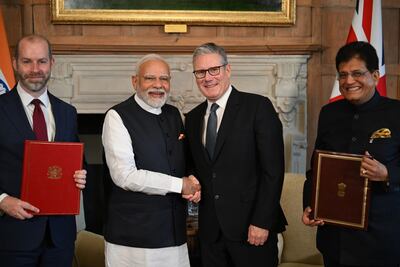

India's Prime Minister Narendra Modi, who is visiting the UK on a state trip, is set to sign a free trade agreement with British Prime Minister Keir Starmer.

Under the agreement, India will get duty-free access to British markets for its textile products and electric cars, while Britain will see a reduction of duty on its vehicles, food and whisky.

The deal, which needs to be approved by the UK Parliament and India’s federal cabinet, probably next year, will see even greater bilateral trade which reached $55 billion last year, said officials.

Downing Street has heralded the agreement as a “win” worth £6 billion to the economy that will also create a further 2,200 jobs, with Indian companies expanding their operations into Britain.

"We both know this is the biggest and most economically significant trade deal that the UK has made since leaving the EU," Mr Starmer told Mr Modi. “And I think I can say that it’s one of the most comprehensive deals that India has ever done."

UK officials said the deal will drive jobs in high-growth sectors such aerospace, technology and advanced manufacturing, the UK government said, and lead to cheaper high street prices with greater choice on clothing, shoes, and food products.

India’s average tariff on UK products will drop from 15 per cent to 3 per cent allowing British companies that sell products to India from soft drinks, cosmetics to cars and medical devices to expand into the subcontinent’s market.

This could see British exports to India increase by 60 per cent “in the long run”, Downing Street said, with a projected addition £16 billion in exports by 2040.

Mr Modi alluded to the England and India cricket test series, ongoing as they met, to add the sport was “a great metaphor for our partnership”.

“There may be a swing and a miss at times but we always play with a straight bat,” he said. “We are committed to building a high-scoring, solid partnership.”

India too claimed a win on the deal with the country gaining access to Britain’s market for electric and hybrid vehicles in a quota system.

Furthermore, Indian commerce ministry officials said, 99 per cent of Indian exports would not have any duties.

British car exports will see their duties cut from 100 per cent to 10 per cent in a quota system as well as tariffs on whisky reducing to 75 per cent from 150 per cent.

There will be further tariff relief for the UK on aircraft parts, electronics and medical devices, it was reported.

Britain has invested $36 billion in India − making it the sixth biggest investor there. More than 1,000 Indian companies operate in the UK, employing 100,000 people and investing $20 billion, a figure now expected to grow.

Mr Modi has gained some credibility from the three-year negotiations after India held to its red lines by winning concessions on work visas and professional qualification recognition, reinforcing India’s growing global services and skills position.

India also managed to keep its agricultural products out of the agreement, as the industry employs 40 per cent of the country. It is also an issue that has dogged trade talks with America.

The agreement can also demonstrate, perhaps worryingly to Washington, that US President Donald Trump’s global tariff wars are pushing other countries to make bilateral deals, potentially at America’s cost.