A hospital in Abu Dhabi has performed the UAE’s first successful penile implant on a young man.

Cleveland Clinic Abu Dhabi carried out the multi-stage procedure, called neophallus reconstruction surgery, on a man born with a condition in which the penis measures less than a centimetre in length.

Traditionally, patients have travelled to Asia for reconstructive surgery, often risking their lives and paying thousands of dirhams to have the procedure done.

The reconstruction required two key stages, with the most critical and final procedure taking place in Abu Dhabi. It involved inserting a metal rod, enabling the patient to have a normal-sized appendage.

Dr Omer Raheem, of the Urology Department at Cleveland Clinic Abu Dhabi’s Surgical Subspecialties Institute, told The National the surgery will open the door for penile reconstruction in the Emirate, eliminating the need to travel abroad.

How and why is it done?

“The surgery requires micro-surgical expertise, plastic surgery, urology expertise and allows us to fashion or refashion the tissue from the forearm to reconstruct and put it inside the patient’s body to become a healed structure,” Dr Raheem said.

Patients undergoing this procedure often have other conditions such as congenital abnormalities, or traumatic loss.

“There are other implications, such as patients who lose their penis unfortunately due to cancer, trauma, or other reasons like end-stage vascular disease,” Dr Raheem said.

The procedure

Initially, skin is taken from the patient's forearm in a procedure performed in preparation for the second operation. This part of the surgery was carried out abroad.

The first stage of the procedure requires six to 12 months' recovery time before the patient can progress to the second phase.

“Once the tissue takes and becomes part of the body and becomes viable, then we come in to place the prosthesis,” Dr Raheem said.

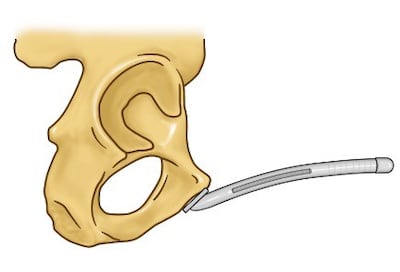

The second stage is a surgical procedure to implant the artificial penis, which takes about three hours. Healing from that takes about six to eight weeks, and then the patient becomes "functional". It was this stage of the treatment that took place in Abu Dhabi, in March.

There are two common types of penile prosthetics: manual and inflatable. The manual post-surgery penis can be operated manually while the inflatable has a squeezable pump inserted inside the body that allows fluid to travel along it.

In this case, the manual prosthetic was chosen.

“We successfully placed an implant of a manual nature, which is a type of rigid prosthesis,“ Dr Raheem said. “This is the first time it has been done in the UAE.”

What was the condition?

The patient was afflicted by a 21-hydroxylase deficiency - a rare condition that disrupts the production of male sex hormones.

In addition to the reconstructed penis, the patient also received artificial testicles. The process is expensive, often costing hundreds of thousands of dirhams.

“They are unable to produce or manufacture sperm to conceive,” Dr Raheem said. “Sometimes they don’t have testicles either so we put artificial ones to feel like or look like normal. We were very pleased with the patient’s recovery. He did fantastic. No complications.”

An artificial penis can reach a normal size of 15 centimetres or more, amounting to normal-appearing functional male genitalia.

What does the future hold?

Although the condition remains rare, Dr Raheem said patients in the region now have access to world-class care. He also urged others to seek medical help where applicable.

“Maybe patients are not seeking the help they need because they’re afraid or they’re shy but this remains a real condition that needs treatment,” he said.