The Sudanese Army appears to be steadily losing ground to the paramilitary Rapid Support Forces as their 14-month war rages on, with analysts now contending that pledges by its chief, Gen Abdel Fattah All Burhan, to fight on until victory might be unrealistic.

The analysts said the army’s lack of combat-ready infantrymen and its inadequate training of tens of thousands of volunteers are mostly to blame for its failure to turn the tide of war in its favour despite its air supremacy.

They believe the war is impossible to win militarily, although the relative dominance of one side – the RSF in this instance – is likely to influence the outcome of any peace negotiations.

The army’s reliance on its air power – bombers and drones – has proven ineffective against agile, lightly armed and combat-tested RSF fighters who have made themselves difficult targets by embedding in residential areas in Khartoum and elsewhere.

Moreover, army air strikes against RSF positions in residential areas have killed thousands of civilians, sparking accusations from human rights groups of war crimes.

“The army’s performance in this war is far less than impressive,” said Sudanese military analyst and retired army general Galal Mahdi.

“It has spent most of its time since the war began defending its bases across the nation against repeated attacks by the Rapid Support Forces.”

Earlier this year, the army went on the offensive in Omdurman, Khartoum’s sister city across the Nile, regaining control of its old quarter and the complex housing state radio and television.

That victory was touted by the army and some analysts as a turning point in the war, but there have been no significant battlefield successes in the capital since.

Witnesses on Tuesday said there was renewed fighting in Omdurman, but there has been no indication of the size of battle or the specific location of its whereabouts. On the same day, Gen Al Burhan said that the “battle noise” in Omdurman will shortly end, appearing to suggest that the army was on its way to another victory there.

The army’s latest battlefield setback came on Saturday when the RSF captured the provincial capital of Sennar state, Singa, in the county’s south-east.

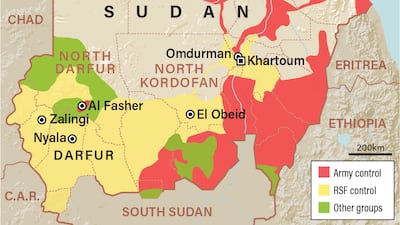

Capturing Singa marks a significant breakthrough for the RSF, cementing the paramilitary’s presence on a new front that, barring unforeseen circumstances, could prove crucial for extending its gains into the agriculturally rich regions of White Nile and Blue Nile close to the Ethiopian border.

It also means that the RSF is tightening the noose around Port Sudan on the Red Sea, which serves as the temporary home for the army’s command as well as government and UN agencies.

The RSF, whose genesis is in a Darfur-based militia called the Janjaweed, has made swift territorial gains from the early days of the war in April 2023 when it took most of the capital, including the armed forces’ headquarters, the presidential palace, the airport and the state TV and radio complex.

The RSF also captured several army bases in the capital. Most similar sites in the capital are under siege by the paramilitary.

In December, the RSF made a significant victory when it captured Wad Medani, the capital of Gezira state south of Khartoum and the country’s breadbasket.

The entire state is now under its control and repeated vows by the army to liberate it are yet to materialise.

The RSF also holds the vast western region of Darfur and much of Kordofan to the south. Its recent inroads in Sennar state place it in a favourable position to march on to the army-controlled south-east.

Gen Al Burhan sought to reassure his troops and volunteers after the most recent battlefield setbacks in Sennar. He has also again rejected any negotiations with the RSF, saying the paramilitary must first leave the private homes they have occupied in areas they control.

“If we lost a battle that does not mean we lost the war,” he said on Tuesday at Wad Sayedna, a sprawling military base outside the capital. “We will not disappoint any Sudanese who believes the armed forces will eventually win.”

Gen Al Burhan's comments, according to Sudanese analyst Khaled Abdul Rahman, indicated desperation and laid bare the limited options available to him.

“His rejection of negotiations and selection to press on with the war appears to be his only choice,” said Mr Abdul Rahman.

“The man appears to be living in isolation from the realities of the war. Losing a battle is very different from losing several battles over a short period of time which is what actually happened. It’s in fact tantamount to losing the war.”

Osman Al Mirghani, a Sudanese newspaper publisher and analyst, disagrees with Gen Abdel Fattah’s choice of continuing to fight on rather than negotiating an end to the war.

The US and Saudi Arabia mediated a series of ceasefires during the early days of the war but they failed to be enforced or collapsed shortly after they began. The warring parties were invited to return to negotiations in Jeddah this year, but Gen Al Buran rejected the offer.

“The end game must come through negotiations. The military solution has a very high cost,” said Mr Al Mirghani, referring to the world’s worst humanitarian crisis unfolding in Sudan, as well as the disruption of education and the country’s key agriculture sector.

The war in Sudan, the latest in a series of domestic conflicts that plagued the nation since independence in 1956, broke out when weeks of tension between Gen Al Burhan and his one-time ally RSF commander Gen Mohamed Dagalo over the mandate of their respective forces boiled over into violence.

The conflict has forced about 10 million of Sudan’s 48 million people to flee their homes, creating the world’s largest level of displacement. It has also killed at least 14,000 people, although the actual death toll is believed to be much higher.

Al Shafie Ahmed reported from Kampala, Uganda.