Consulting firm Alvarez & Marsal has released an uncompromising forensic report on the management of Lebanon's central bank, which points to its former governor Riad Salameh's distinct role in overseeing the bank, characterised by a “personalised” and “unscrutinised” approach.

Lebanon is grappling with one of its worst economic crises, marked by financial sector losses amounting to $70 billion and the national currency losing about 98 per cent of its value.

Alvarez & Marsal was tasked in September 2020 with conducting a forensic audit of the regulator, Banque du Liban.

The objective was to examine financial transactions in accordance with the law and uncover potential misappropriations.

The forensic audit – which encountered numerous obstacles and delays and faced resistance from BDL – was presented to caretaker Finance Minister Youssef Khalil on Thursday.

Spanning 332 pages across 14 sections, the report, seen by The National, covers the period from 2015 up to early 2020.

It scrutinised compliance and internal controls at BDL and uncovered irregular accounting practices, a lack of transparency and weak control mechanisms.

Riad Salameh emerged as the main decision-maker, with very limited checks on his authority.

Here are the main findings:

New evidence of illegitimate commissions

This is probably the most significant discovery in the report: Alvarez & Marsal found evidence of “illegitimate commissions totalling $111 million” during the specified period.

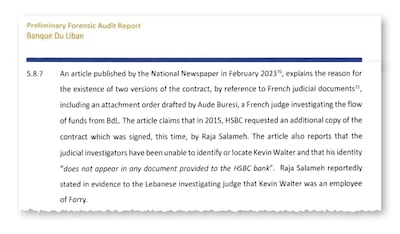

This complements the continuing examination of suspicious commissions totalling $330 million that were funnelled into Forry Associates Ltd from 2002 to 2016.

European investigators suspect that Mr Salameh channelled public funds through Forry, his brother's company, under an irregular agreement with Lebanon's central bank.

During this time, Forry would collect a commission of 0.38 per cent from commercial banks – without them knowing and without the former providing any services in return – each time they bought financial instruments from the central bank.

Citing The National's reporting, Alvarez & Marsal examined the concerns surrounding these commissions.

Their analysis unveiled additional intermediaries, highlighting the presence of further commissions channelled into the same “consulting account”.

The National previously exposed the mechanics of the alleged scheme within BDL, which involved Forry portrayed in judicial documents as a seemingly shell company that received commissions without providing any corresponding services.

Based on official documents, our investigation traced the money from the “commission account” at BDL to upscale European real estate tied to Mr Salameh and his associates, now seized by the European judiciary.

Mr Salameh, who had arrest warrants issued against him by France and Germany over the alleged embezzlement, was placed under sanctions by the US on Thursday for his “corrupt and unlawful actions [that] have contributed to the breakdown of the rule of law in Lebanon”.

It is worth noting that the Alvarez and Marsal report mainly studies the post-Forry era, as transfers to the company stopped after 2015.

“This appears to be a continuation of the commission scheme under investigation by Lebanese and international prosecuting authorities,” the auditors wrote.

The account was credited through different ways, including through transactions with Optimum Invest, a Lebanese broker, and from payment transfers received from Lebanese bank AM.

These transactions appear “highly irregular”, the auditors wrote.

However, Alvarez & Marsal could not pinpoint the ultimate beneficiary's name or account for transfers from the “consulting” account at BDL where the commissions were deposited, as the central bank withheld beneficiary details from Swift extracts, citing banking secrecy laws.

BDL also declined to arrange face-to-face interviews with its employees, leading to the adoption of a written questionnaire approach restricted to a specific number of staff members.

Unconventional accounting practices

Alvarez & Marsal also challenged BDL's “non-traditional” accounting standards, which allowed the institution to publish its financial data opaquely and conceal its losses.

They said that the central bank used a number of non-conventional methods to manage its balance sheet, maintaining a facade of profitability every year and allowing it to consistently allocate about $40 million annually to the Ministry of Finance's account.

Over the course of several decades, BDL allocated losses accumulated on its capital to a designated account, with the intention of offsetting them through future revenue.

Such revenue is referred to as “seigniorage” – the earnings generated by a central bank from the issuance of money or from banking intermediary activities.

However, the BDL overused this approach to mask its rocketing losses, which particularly increased from 2016 onwards.

“Even an unconventional accounting policy, in order to be a policy, needs to have certain basic features, eg to be clearly stated, capable of being audited and not dependent upon ad hominem judgment. The BDL's accounting policy failed in this respect,” the auditors wrote.

According to the auditors, the BDL moved from a foreign currency surplus of 10.7 trillion Lebanese pounds ($7.2 billion) in 2015 to a deficit of 76.4 trillion pounds ($50.7 billion) at the end of 2020.

This deterioration “was not reported in BDL's balance sheet presented in its annual financial statements, which were prepared using unconventional accounting policies”, the report added.

Lack of internal controls

Alvarez & Marsal also criticised the lack of overall good governance and risk management arrangements at the central bank, as well as Mr Salameh's role “as the key decision-making figure”, saying he “exercised largely unscrutinised authority”.

“This was possible due to weak governance and controls framework internally, and a largely ineffective and understaffed external supervisory mechanism”.

According to Lebanese law, the Central Council, which is supposed to govern the BDL and set the monetary policy, was “largely ineffective as a governing body, with no challenge to the governor's exercise of decision-making power ".

The Central Council, whose decisions are arrived at by a majority vote, includes the governor, four vice governors and two government representatives, namely the director general of the Ministry of Finance and the director general of the Ministry of Economy and Trade.

Alvarez & Marsal said that they had “not identified any challenge or dissenting opinions/views in these minutes.”