A ship carrying diesel from Iran to Lebanon has raised Tehran’s profile as a major force in the country and could thrust Lebanon into US sights, analysts say.

The leader of Lebanon's Iran-backed Hezbollah movement said “the first of many ships” carrying Iranian diesel to Lebanon set sail on Thursday.

A shortage of foreign currency resulting from Lebanon's financial crisis has led to shortages of fuel for its power plants and extended electricity cuts.

The country has also restricted imports of petrol and diesel, affecting motorists and operators of the private generators that make up the shortfall in the state electricity supply.

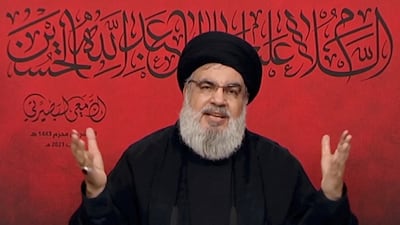

Hezbollah leader Hassan Nasrallah announced the Iranian fuel shipment during a televised speech to mark Ashura, an annual Shiite day of mourning. He warned the US and Israel against interfering, saying he considered the tanker to be on Lebanese soil from the moment it set sail.

“This announcement in itself puts Lebanon in danger,” said Laury Haytayan, a Middle East oil and gas expert.

“The ship is carrying a product that is under US sanctions. Anyone who engages with that product could be sanctioned. Is Hezbollah really willing to put the Lebanese government at risk?”

Middle East oil and gas expert

Importing oil from Iran “is not a solution to the fuel crisis. This is a political move,” she said.

Ms Haytayan said there were two main routes for the Iranian shipment to reach Lebanon: the ship could dock in Baniyas, Syria, and offload the fuel for delivery by land, or it could sail to a Lebanese port, presenting officials with the decision of whether to receive it and risk US sanctions.

She said the Lebanese government could ask for a waiver of the sanctions, such as the ones granted to Iraq for Iranian gas imports.

However, the shipment appears to be entirely a Hezbollah initiative, with no involvement from the government. A spokesman for the Lebanese president told The National that Iran had made no formal request to send diesel to Lebanon, and Beirut had taken no practical steps to this effect.

Commenting on Iranian reports that the oil was purchased by Lebanese Shiite businessmen, a Hezbollah spokeswoman told The National there was “a high probability”.

“We cannot disclose their identity for fear that they will be targeted [by a] US siege,” she said.

The diesel will be sold in the Lebanese market at the price it was purchased, she said.

“It is not for trade, but to help Lebanon as much as possible.”

The American ambassador to Lebanon has hinted that the US might choose not to act.

“I don’t think anyone is going to fall on their sword if someone’s able to get fuel into hospitals that need it,” Dorothy Shea said in an interview with Saudi website Al Arabiya.

Political analyst Bachar El-Halabi said Hezbollah stood to benefit whether the fuel reached Lebanon or not.

“Hezbollah wins if the shipment arrives and it wins if the shipment does not arrive,” Mr El-Halabi told The National.

“If the ship is intercepted by the US or Israel, this would vindicate the group’s rhetoric that Lebanon is under siege. If it arrives on Lebanese soil, Hezbollah can claim it saved the country.”

political analyst

Hezbollah is the only civil-war era militia to have kept its weapons arsenal to this day. Lebanon was at war with itself for 15 years until 1990.

It holds great influence over a fragmented country that has faced economic collapse for the past two years.

The group has operated for decades as a parallel state, with its own armed forces that have been involved in conflicts from Syria to Yemen without the government’s assent.

Imad Salamey, an associate professor at the Lebanese American University, says the Iranian fuel shipment is a sign of the group's growing hegemony over the fragmented state, where control is divided on sectarian lines.

The diesel shipment is “a serious breach” of Lebanese sovereignty and rule of law, he said. “The state should govern interactions between a foreign government and Lebanon, not one party.”

Hezbollah's move also exposed the waning influence of western nations, Mr Salamey said, citing the muted American response.

“The US and Europeans are becoming irrelevant in the political process in Lebanon. The real power here is Iran and the Syrians.”

If the diesel delivery succeeds, it would mean energy imports are out of state control and open a door for other parties to follow suit.

“It could bring Lebanon back to a war-era scenario where every party imports and exports its own products, including illegal products,” Mr Salamey said.

“This is what this process will lead to eventually.”