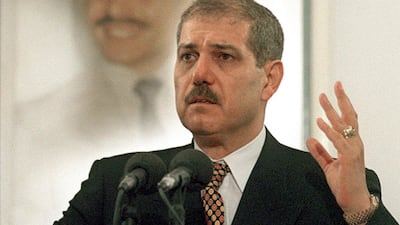

Jordanian economist Fayez Tarawneh, who led his country's delegation to peace talks with Israel in the 1990s and served as prime minister twice, died on Wednesday at the age of 72.

Tarawneh was a confidant of the late King Hussein, representing Jordan at a crucial foreign policy juncture that resulted in long-term security arrangements with Israel and a firmer alliance with the US.

“Jordan lost one of its loyal men,” Prime Minister Bisher Al Khasawneh said in an official announcement of the death of Tarawneh. Local media reported that he died of a terminal illness.

The Palestine Liberation Organisation under Yasser Arafat had signed the Oslo Accords with Israel. Syria's president at the time, Hafez Al Assad, leaned towards striking his own deal with the Israelis when King Hussein agreed to the talks.

For decades Jordan had fended off accusations by some Palestinians and "rejectionist" regimes, such as in Syria, that it was willing to compromise on the Palestinian cause.

Jordan rejected efforts by Egypt's Anwar Sadat to include it in peace talks with Israel in the late 1970s.

So when Arafat agreed to Oslo, which promised Palestinians self-determination but did not ultimately deliver, and talks between Assad and Israel progressed, Jordan thought itself vindicated in having struck its own deal.

Washington initiated talks between Jordan and Israel in late 1993, and as peace between Assad and Israel appeared imminent, King Hussein ordered Tarawneh, who was also Jordan’s ambassador to Washington, to wrap up the negotiations.

In October 1994, Jordan signed the peace treaty with Israel, known as the Wadi Araba Accord. Assad, for reasons that are still the subject of debate, eventually refused to sign a deal.

“Palestine has its own men,” King Hussein told Tarawneh and other members of the Jordanian delegation in 1994.

They were briefing the monarch on details of maximalist positions the Jordanian side had taken on formulating treaty clauses regarding the sharing of resources in the hope of safeguarding Palestinian water rights.

Two terms as PM

Tarawneh was a staunch royalist and obeyed King Hussein in accelerating the deal. Like many Jordanian officials, he was wary of Jordan becoming an "alternative homeland" for the Palestinians as Israel expanded settlement building and its expropriation of Palestinian land.

He later noted that the treaty regained 340 square kilometres of Jordanian land, without what he described as any adverse effect on the “overarching goal” of a comprehensive Middle East peace that would restore Palestinian rights.

Like his mentor, King Hussein, Tarawneh was highly pragmatic.

The New York Times reported that Tarawneh was sitting among the Arab ambassadors on the White House lawn who witnessed the signing of the 1993 Oslo Accord between Yasser Arafat and Israeli prime minister Yitzhak Rabin.

Rabin went to where the ambassadors were sitting to shake hands with them. Most of the Arab envoys shook hands with him and unease appeared on the face of Syrian foreign minister Walid Mouallem. But Tarawneh was comfortable.

"Nobody told us this was going to happen," Tarawneh said, "but we are gentlemen after all."

"When I meet the Israeli ambassador at a reception, I don't hide behind a pillar. We do shake hands. Shaking hands does not really change anything."

Tarawneh graduated with a doctorate in economics from the University of Southern California in 1980. He sat on the board of several private companies and was seen as being in favour of maintaining a large role for the Jordanian government in the economy.

In 1998, a year before King Hussein’s death, the monarch appointed Tarawneh, then chief of the Royal Court, as prime minister.

He held the position until King Abdullah II became monarch in 1999.

In 2012, King Abdullah reappointed him as prime minister for five months, as the Jordanian economy floundered.

Tarawneh remained close to the new monarch, serving once again as chief of the Royal Court.

King Abdullah is expected to attend his funeral in Amman.