Egypt’s government does not have the right to transfer ownership of the Suez Canal to any foreign entities, the waterway’s chief said on Thursday.

Admiral Osama Rabie held a special news conference in response to mounting public outrage over a draft law submitted by the government to parliament on Monday seeking to allow the waterway's authority to launch a 100-billion-Egyptian-pound ($4 billion) private fund to increase its revenue.

The draft law, which was preliminarily approved in parliament pending a final vote at a later date, was strongly opposed by several MPs, many of whom expressed concerns over the involvement of foreign entities in the fund’s projects and the possible privatisation of business activities related to the canal.

If approved, the fund would allow the authority — whether independently or in partnership with third parties — to use its capital to establish companies and invest in securities and private ventures.

“The fund has nothing to do with the canal or the authority,” Admiral Rabie said at Thursday’s press conference, adding: “It is an entirely independent entity with its own budget and operation plan.”

Since Monday, Egypt’s social media channels have also been flooded with posts from people worried that one of the country’s most important patriotic symbols is being privatised.

The creation of the fund would reduce the financial burden on the state’s coffers, Admiral Rabie said, as the authority would only be transferring whatever was left over from its annual budget into the fund each year, after giving the lion’s share to the central bank and paying its operational costs.

“This is the portion of our budget that President El Sisi said we should set aside or possibly grow into a fund for a rainy day,” Admiral Rabie said. “We wouldn’t need to resort to state funds for anything, the fund would have a separate budget.”

He said the authority intends to use the fund to launch mega projects to benefit the canal, including a plant to build giant container vessels.

Thursday’s conference, broadcast live on television and online, was also attended by Diaa Rashwan, the head of Egypt’s journalists’ syndicate and the general co-ordinator of the National Dialogue, a forum set up by Mr El Sisi as a means of conversing with the country’s disgruntled opposition parties, many members of which are imprisoned or in pretrial detention.

The dialogue was convened following repeated complaints from western governments about Egypt’s human rights record.

Rashwan said: “Just 48 hours after parliament discussed the matter, President El Sisi directed us to convene an open meeting about the fund which would be broadcast live.” He added that indicated the President could appreciate that the canal concerns all Egyptians.

The issue of the large number of private funds that exist in Egypt, which many see as an impediment to financial transparency on state and private-sector spending, was also addressed on Thursday.

“Some economists in the country feel that private funds are not included in the national budget and other economists feel that they are,” Rashwan said. “Disagreements on the issue emerge from this difference in economic perspective.”

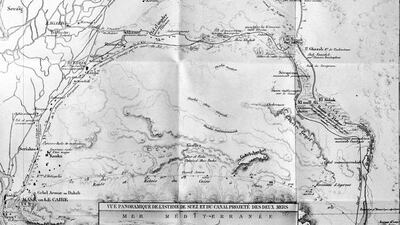

Admiral Rabie and Rashwan both spoke passionately about the importance of the canal to Egyptians’ national identity, since it was dug up in the 1850s by 1 million Egyptians, at that time about 25 per cent of the country’s population.

Admiral Rabie noted on Thursday that 120,000 Egyptians died digging up the waterway.

“To anyone who has doubts that establishing the fund will diminish Egypt’s sovereignty of the canal, I will respond with what is plain as day, at least to me — there is not a single inch of Egyptian land being relinquished to anyone,” Rashwan asserted.

“President El Sisi, like the leaders who came before him, is the custodian of the canal and the blood that was spilt to dig it.”