Iran tried to seize two tankers in the Strait of Hormuz, firing at one vessel, the US Navy said on Wednesday.

The Iranian Navy retreated after the US Navy responded to distress signals and both commercial ships continued their voyages, it said.

“The Iranian Navy did make attempts to seize commercial tankers lawfully transiting international waters,” said Cdr Timothy Hawkins, a spokesman for the US Navy's 5th Fleet.

He said the navy “responded immediately” but that Iranian forces had fired shots during the attempted second seizure.

The US Central Command said the first ship Iran sought to seize was the Marshall Islands-flagged TRF Moss, which was in the Gulf of Oman when an Iranian vessel approached at 1am local time on Wednesday.

“The Iranian vessel departed the scene when US Navy guided-missile destroyer USS McFaul arrived on station,” Centcom said.

Three hours later, the US Navy received a distress call from the Bahamian-flagged Richmond Voyager, which was positioned more than 30km off the coast of Muscat.

Another Iranian naval vessel was close to the tanker and messaged it to stop.

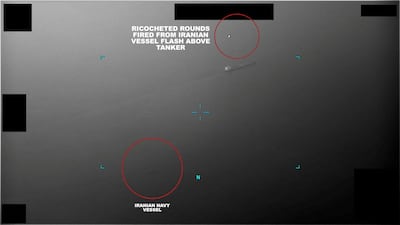

Before the arrival of the USS McFaul, “Iranian personnel fired multiple, long bursts from both small arms and crew-served weapons,” Centcom said.

Several rounds hit the hull of the tanker but there were no casualties or significant damage, it said.

The UK Maritime Component Command on Wednesday called the incidents “unacceptable harassment, threatening freedom of navigation and harming global trade”.

Tehran has seized several vessels in the Arabian Gulf during heightened tensions with the US, which has navy patrols in the area.

In May, it seized two tankers in a single week and has been accused of holding a vessel as a “bargaining chip” over a payment dispute.

The UK's Maritime Trade Organisation also reported the “suspicious incident” involving “national maritime forces” off the coast of Oman, but did not name Iran.

Maritime security company Ambrey said the second ship was a Bahamas-flagged oil tanker, which is Greek-owned and US-managed.

It continued its journey through Omani waters but increased its speed and changed course after the incident, according to Ambrey.

Tehran has seized at least five commercial vessels in the past two years and has harassed several others, the US Navy said.

Tensions between Tehran and Washington increased after the US withdrawal from the 2015 nuclear deal.

President Donald Trump in 2018 reinstated sanctions on Tehran and later ordered the assassination of Islamic Revolutionary Guard Corps commander Qassem Suleimani, sending relations into deeper crisis in early 2020.

Iran has responded by increasing its nuclear activities – which it says are peaceful – and is also providing armed drones to Russia for its war against Ukraine.

Agencies contributed to this report