Sixteen artefacts are expected to arrive in Egypt from the US within a few days after being seized by authorities in the state of New York.

Egypt’s antiquities ministry said it co-operated with New York prosecutors and Egyptian foreign ministry officials in the US to repatriate the pieces, which date back to various eras of Egypt’s history.

Three separate American investigations were conducted into the matter, according to the antiquities ministry. The investigations conclusively determined that the artefacts were smuggled out of Egypt illegally.

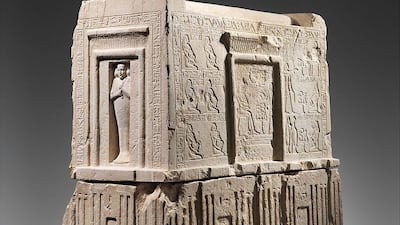

Among the 16 pieces was a piece of a wooden coffin with a layer of coloured plaster on it depicting a woman’s face, a limestone slab decorated with hieroglyphs and a scene of people making a sacrifice to the gods.

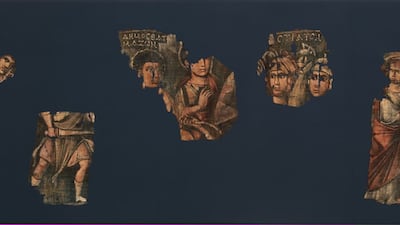

Also recovered were five separate pieces of the same linen cloth decorated with drawings of the Israelites crossing the Red Sea, reportedly a Byzantine illustration of scenes from the Book of Exodus.

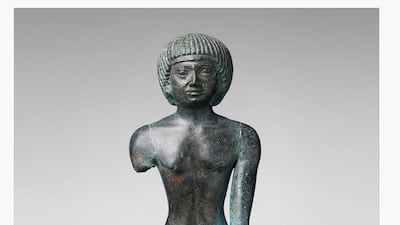

Another piece, dating back to Roman rule in Egypt (30 BCE — 641 CE), depicts a woman in the style of the Fayyum Portraits, a collection of paintings which were a Roman update on the way Egyptians depicted their pharaohs.

Additionally, a gold coin dating back to Ptolemaic Egypt was among the repatriated artefacts.

The items also included nine pieces which had been illegally in the possession of an American businessman, investigations determined.

They are expected to arrive at the Egyptian Consulate in New York within a few days, and then to be returned to Egypt, the ministry said.

Egypt, which possesses a wealth of historic artefacts, has in recent years intensified its efforts to combat rampant smuggling and repatriate smuggled pieces.

In December last year 36 pieces were returned from Valencia, Spain after being smuggled out in 2014.