Footballers love Dubai. Even at the time of writing, Portuguese forward Cristiano Ronaldo and Luka Modric, captain of the Croatian national team, are two of a handful of football players holidaying in the emirate.

It was no different in 2009, when the AC Milan and Hamburg SV teams flew over to the UAE, back when Ronaldinho was a star of the Italian side.

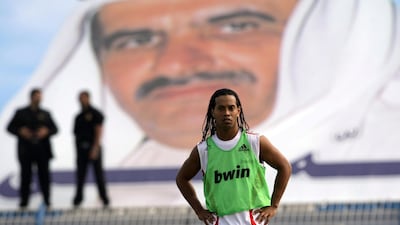

Here, the Brazilian footballer is pictured at a training session on Saturday, January 3, having arrived in Dubai on Monday, December 29, for the team's official winter training camp, which culminated in the Dubai Challenge Cup match.

The cup, which was founded by Sheikh Mohammed bin Rashid, Vice President and Ruler of Dubai, was a friendly football tournament that was first held in January 2007.

For the first two years, it included four teams, with the UAE national team playing, too. In 2009, however, a single match was played on Tuesday, January 6, with Milan beating Hamburg in a penalty shoot-out. In fact, AC Milan went on to win the tournament every year until 2014, when the final event was held.

To this day, however, it’s not uncommon to see some of the world’s best football teams, particularly those from chilly Europe, flying to balmy Dubai for training camps in the winter months. They include the likes of Manchester United, Inter Milan and Paris Saint-Germain, with others, such as Newcastle United and Manchester City, making pit stops in the capital instead.