Saudi-British singer Alewya is one of the stars of the recent pre-autumn fashion campaign by Loewe.

Shot by the idiosyncratic German photographer Juergen Teller, the images capture a whole host of famous people in unguarded poses.

The Spanish luxury house has put an attitude of fun and playfulness at the heart of everything it does since coming under the control of creative director Jonathan Anderson in 2013 — and this campaign is no different.

Alewya, whose full name is Alweya Demmisse, is featured sitting on a drum, with her locs and fabulous metal-sheathed nails on full display.

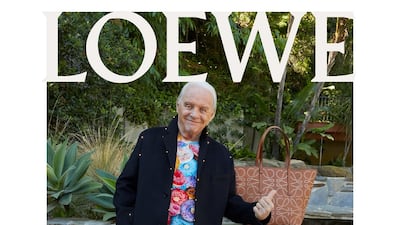

She stars alongside Academy Award-winning actor Sir Anthony Hopkins, who is giving a cheery thumbs-up, and Josh O'Connor, best known for playing the young Prince Charles in British TV series The Crown.

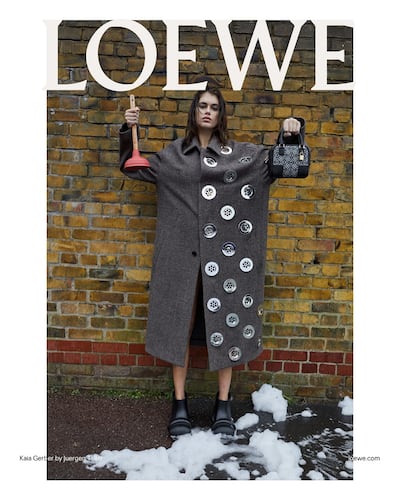

Model Kaia Gerber, meanwhile, appears twice: once in a bath in the middle of the road, and again clutching a sink plunger while wearing a coat decorated with sink plugs sewed on like giant buttons.

K-pop star and solo artist HyunA, a Loewe ambassador, also features, alongside Japanese Paralympic athlete Maya Nakanishi, who won gold in the long jump at the 2019 World Para Athletics Championships in Dubai.

American artist Lynda Benglis, 80, also makes an appearance wearing a colourfully mismatched jumper and tracksuit bottoms.

With Anderson at the helm, Loewe, which was first founded in 1846, has been steered towards a high-end version of irreverent happiness that is spreading, slowly but surely, throughout the whole fashion industry.

Who is Alewya?

Born in Saudi Arabia and raised in the UK, the singer-songwriter Alewya Demmisse draws on her Arab heritage in her work. She's influenced by her Egyptian father's Sudanese roots and the culture of her Ethiopian mother to create a unique sound that has put her on every "one to watch" list of note, including 2021's NME 100, Essential emerging artists list.

While dancing in a crowded scene for the film Kids in Love, Demmisse was spotted by Cara Delevingne, who persuaded her to take up modelling. She went on to sign with Women in New York and Storm in London, and Vogue described her as its "new model obsession."

Demmisse soon relocated to New York for modelling, sharing a flat with fellow models Adwoa Aboah and Binx Walton, and walking for DKNY during the New York Mercedes-Benz spring-summer 2015 fashion week. She then returned to the UK to study maths and philosophy at King's College, London.

Despite not picking up a guitar until the age of 21, her main focus now is music. She released her debut single in 2020 and appeared as a guest on one of Little Simz's records, going on to support the rapper for his 2021 UK tour.

Demmisse, 27, whose name means "most high" in Amharic, is also a self-taught artist, working in illustration and sculpture. Her scratchy, powerful, female-dominated artworks, along with her music and modelling career, prompted Love Magazine to describe Demmisse as the "triple threat" of the decade.