When friends Fiona Cox and Lizzie Thornton-Allan left London to bring up their children in the Somerset countryside, they both wanted flexible jobs so they could work from home. As Fiona had previously worked as a stylist and TV presenter and Lizzie was a film producer, both were very visual, with great creative credentials. In 2001, they teamed up to start Cox and Cox, their own online shop selling gorgeous home accessories and gifts. Later, Michelle Follett-Holt joined them - bringing with her a successful catalogue called Cowboys and Cupcakes - and Cox and Cox became the daddy of UK mail-order shops.

If you're bored with mass-produced tat, you'll be happy here. Every season, the team scours the globe for beautiful buys and items you won't have seen elsewhere. Homeware-wise, there's a mind-boggling array - everything from candles to compost buckets - it's a site to bookmark and browse at leisure on a regular basis.

I recently bought some quirky tealight holders, with vintage typographical motifs on them - a heart, a pointing hand and a crown - which look gorgeous in a line down the centre of the table for an elegant dinner party. Now I've got my eye on the pretty mercury glass candlesticks, too - they look like expensive antiques - and there are some jewel-coloured espresso spoons and small china bowls which will inevitably slip into my shopping basket one day.

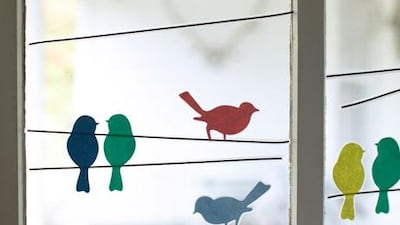

If you're decorating a children's bedroom, have a peep at the cute bird window stickers: You get 10 perching birds and 10 wires for them to sit on, so you can create your own display. This is also a one-stop shop for brides and party planners. Table decorations, placename holders, confetti, unusual favours and stunning outdoor lighting - it's all here.

The Creative Diva section is where I spend most of my time - it's full of all things fun and quirky. Rubber alphabet stamps for making bespoke stationery, a paint-your-own Russian doll kit and cookie cutters shaped like feet or jigsaw pieces - at Cox and Cox, you never know what you'll stumble upon next.

For shipping prices call 00 44 0844 858 0744 or see www.coxandcox.co.uk