The humble polka dot, aside from adorning the Duchess of Cambridge at the service of thanksgiving for the life of Prince Philip, has enjoyed a wide and varied history.

Throughout the Middle Ages, Europeans generally avoided spotty patterns, largely to its unfortunate resemblance to the blotches and boils of the plague and smallpox — both virulent diseases at the time.

During the 1800s, however, that all changed, when a new dance craze called the polka swept across Europe. The exact origins of the name are a little hazy, with many favouring the theory that it referred to the Czech word pulka, meaning half, in reference to the small steps taken in the dance.

The arrival of the Industrial Revolution, and mechanised weaving in the late 1700s, meant that, for the first time, it was possible to produce identical, evenly spaced dots across a length of cloth. This led to something of a frenzy for the new design, around the same time as the dance, so the names began to merge.

It is not clear how or when this happened, but fashionable ladies rushed to be seen in the new pattern, resulting in must-have items such as the polka jacket and the polka hat. While these have all since faded from memory, the polka dot has survived.

The English name "polka dots", however, first appeared in print in 1857, when the Godey’s Lady’s Book, a women’s magazine of the time, described a “scarf of muslin, for light summer wear, surrounded by a scalloped edge, embroidered in rows of round polka dots." Until this arrival, spotted fabric had gone by various monikers, including dotted-Swiss, the Spanish name lunares, the French term quinconce, and thalertupfen in German.

While the dance slipped into obscurity over the years, the pattern has remained, becoming an accepted fixture with its suggestion of a clean-cut wholesomeness. When Norma Smallwood became the first Native American woman to be crowned Miss America in 1926, she wore a polka dot swimsuit, while in 1935, Walt Disney dressed the character Minnie Mouse in yellow polka dots for the first time — yes, yellow, her famous red and white look didn't appear until 1941.

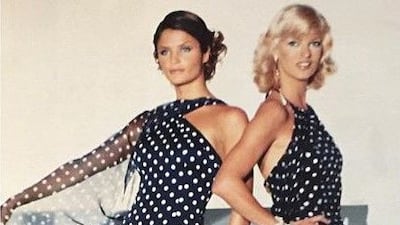

During the 1950s, everyone from Marilyn Monroe to Elizabeth Taylor was seen in the jaunty, summery print, and by 1954, the best selling version of Christian Dior’s famous New Look was the polka dot. Hubert de Givenchy launched his owned spotty gown the following year, reversed as black on white, while for Carolina Herrera, the design was so key to her work in the 1980s and 1990s, that when she launched her first fragrance in 1988, it arrived in a polka dotted box.

Another British royal, Princess Diana, was a big fan of polka dots, and wore them repeatedly during her lifetime, including when leaving the hospital clutching her newborn son, Prince William, in 1982. This was mirrored by Prince William's wife, Duchess of Cambridge, who wore a blue polka dot dress to leave the hospital with their firstborn, Prince George, 31 years later in 2013.

Julia Roberts's character wore a polka dot dress in the 1990 film Pretty Woman. While the film delivers some very dubious messaging, it is notable that when her character wants to appear of higher social status, she opts for a polka dot dress and a straw boater.

Fashion brands have too embraced the trend, most notably Dolce & Gabbana, where the pattern has been reworked numerous times, making it part of the house's DNA, while brands such as Gucci, Armani, Marc Jacobs, Balmain and even Versace have all, at some point, embraced the dots.