Dr Michael Ebner wants to give surgeons superpowers to see what is currently invisible, with an artificial intelligence-powered imaging device that detects the unseen blood flow in tissue.

To give surgeons a glimpse of any malignancies lurking beneath the skin’s surface, the technology splits light into spectral bands far beyond the conventional red, green and blue that the naked eye can detect.

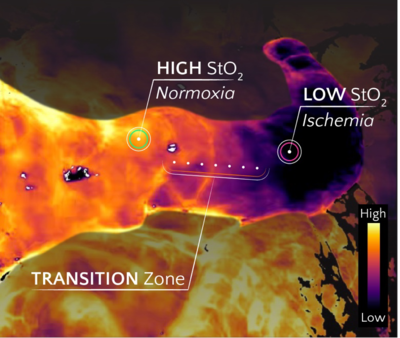

It reveals the differences in perfusion – between healthy areas that appear brighter, and darker, problematic patches with poor blood flow.

And in addition to making a surgeon’s job easier, Dr Ebner suggests it will reduce complications and increase survival rates.

Being able to better see tissue health during surgery could prevent many complications, says Dr Ebner.

“If the surgeon at the time had a much better understanding about what’s healthy and what’s not this can be game changing, both in terms of precision and also outcomes and to prevent complications,” he adds.

His company, Hypervision Surgical, is one of the first to be spun out of the UK’s new medical tech builder, the London Institute for Healthcare Engineering (LIHE), which was launched earlier this year and aims to helps academics and entrepreneurs to get their ideas to patients faster.

That is badly needed, according to its head, who says comparatively few life-saving innovations make it patients due to the complexities of bringing MedTech to market.

The approach is very much in line with the approach taken by the UK's new Health Secretary, Wes Streeting, who wants to work with the private sector to reduce the burden on the NHS.

He told The Guardian in a recent interview that the door should always be left open to dealing with the private life sciences and medical tech sectors, adding: “If we can combine our country’s leading scientific and tech minds with the care and capacity of the NHS then the sky is the limit.

“I’m fed up with this binary view.”

LIHE's director, Prof Sebastien Ourselin, says the UK has one of the most prolific lifescience and medical portfolio activity anywhere in the world.

“But if you look at our economy we make out of this with companies it’s much smaller,” he adds, while on a recent tour of the centre attended by The National.

“So there is certainly a need to bring a sense of entrepreneur culture.”

Other innovations the centre is working on include tech that detects abnormalities of babies in the womb using data from ultrasound scans.

“Congenital heart disease in babies is very often missed because it’s such a rare event that the sonographer scanning the lady expecting misses it,” says Dr Nicolas Huber, the centre’s Director of Commercial Operations and Partnerships.

“This technology interfaces with the ultrasound machine completely without interfering in the clinic itself.”

As the sonographer is scanning, the programme is performing calculations in the background and producing a risk score. If it identifies something they may have potentially missed, it is flagged and send it to experts for another look.

Another technology in development is a special bandage with tiny “nano” needles that deliver drugs directly into the skin painlessly.

There is also a micro robot, which can be inserted into the ear canal and inflated in order to stabilise a needle to pierce the ear drum safely.

“It’s going to spin out in the next few months. It has attracted so much attention,” says Dr Huber.

“The inventor is going to join the Royal Academy of Engineering Fellows, which is a huge moment for us and for him. It’s one of our top technologies.”

It currently takes 10 to 15 years to develop a medical device. The centre aims to cut that to less than five.

One of the biggest problems inventors experience is where to start.

Academia doesn’t prepare you for being an entrepreneur and fighting the battle out in the market place, says Dr Huber.

That is where LIHE comes in.

“What we are doing here is we are bringing together all of the experts and all of the elements required for our scientists to become entrepreneurs and to start off with robust companies,” he adds.

The centre is located in London on the site of St Thomas’ Hospital, where the technology is tested. A handful of partners, including AI giant Nvidia and Siemens, have a base at LIHE, to make it easier to share their expertise.

“To have all of the experts together in one room, plus, critically from day one, strategic guidance.

“So we will be thinking, yes we have a fantastic innovation, but what is the best country in the world to buy this system globally? Who are the best industry partners to speak to? Who are the best advisers you can have on your company board? Almost none of [this] passes through an academic’s mind.”

Dr Ebner’s company has already been spun out from the centre and is now awaiting clearance to carry out a UK trial using the technology.

He says: “If things go well we should have clearance within the next few months. This would then start a UK-based three-centre clinical trial by the end of the year.”

The impact could be huge.

“What we know based on proxy data is with perfusion understanding of the sort we have, around 50 per cent of potential complications can be prevented,” he adds.

“So this is quite a striking number. It’s a new paradigm.”