A long-delayed road project between Oman and Saudi Arabia through the world’s largest sand desert is in the final phase of construction, officials said on Tuesday.

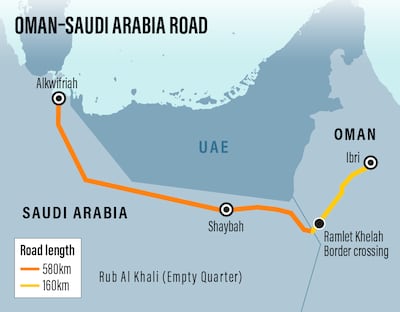

The new road starts from Ibri, a town in south-west Oman, and ends in Al Ahsa in east Saudi Arabia, saving 16 hours of travel time compared with the existing road.

The 720-kilometre motorway was originally scheduled for completion in 2014, but was delayed because of technical issues.

Salim Al Naimi, Undersecretary for Oman’s Ministry of Transport, Communications and Information Technology, said the project could be completed by the end of 2021.

“Finally, we are going to complete the road project after many years since the start of the construction,” Mr Al Naimi told Oman TV.

“There were many technical problems because the road is being built in a very remote desert. Hopefully, it will be completed by the end of this year or the beginning of next year.”

He did not say how much it would cost, but industry experts close to the project said the project will come in at about $475 million to complete.

“The initial cost to complete the project was estimated at about $350 million but because of technical problems, the final price is now expected to be about $475 million,” the industry expert told The National.

It passes straight through the Rub Al Khali desert, known as the Empty Quarter, which spreads over Oman, Saudi Arabia and the UAE. The section of the road in Oman is about 160km long while about 580km is in Saudi Arabia.

When completed, the new road will save more than 16 hours in the travel time between the two towns at each end of the route. The existing 1,600km road linking the two nations also cuts through the desert, but via a much longer route. It was built more than 40 years ago.

Seyyid Faisal bin Turki, Oman’s ambassador to Saudi Arabia, said on Oman TV that the new road will boost commercial activities between the two countries.

“The road, when completed, will increase foreign trade between Oman and Saudi Arabia. It will also speed up exports between the two countries in the shortest period of time and that will contribute to cost-saving because of the shorter route,” he said.

Oman exports fish to the Saudi market while Saudi Arabia provides dairy produce, vegetables and petrochemicals to Oman.

Earlier this year, Oman and Saudi Arabia held a series of talks to boost trade relations. Oman’s minister of commerce, industry and investment promotion revealed that an Omani-Saudi Business Council is in the works.

Omani businessmen say they are looking forward to the completion of the new road boosting trade.

“It takes a long time to export anything to Saudi Arabia with the existing road. The new road will cut travel time by more than half. We have to drive for nearly 18 hours to reach Saudi Arabia. I calculate that the new road will take only six hours,” said Khamis Al Shibli, 44, an Omani fish exporter from the town of Ibri in Oman.

Other Omanis said the road will also benefit tourists and pilgrims.

“Omanis who are living in the south-west of the country will find it easy to use the new road to visit Saudi Arabia for tourism purposes and the Makkah pilgrimage. It will be quicker and a cheaper mode of transport, too,” said Hamed Al Abri, 34, a resident of Ibri.