Hours after president-elect Donald Trump told reporters that he had a "soft spot" for the embattled social media platform TikTok, its parent company ByteDance appealed to the Supreme Court to stop a bill that could result in the platform being banned in the US.

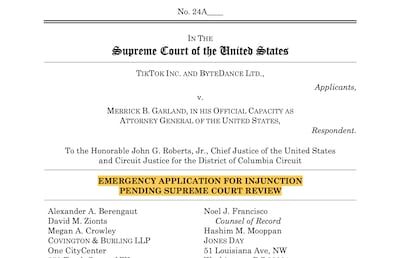

"TikTok is asking the court to do what it has traditionally done in free-speech cases: apply the most rigorous scrutiny to speech bans and conclude that it violates the First Amendment," the company said on its website, along with a link to the full Supreme Court appeal.

"The Supreme Court has an established record of upholding Americans’ right to free speech." The statement also claimed that if TikTok is banned in the US, small businesses and creators on the platform would lose more than $1 billion.

TikTok's lawyers recently failed to convince judges in a US federal appeals court to strike down a bipartisan ban passed by US Congress, which seeks to force TikTok to be divested from ByteDance due to national security concerns.

Legislators and data-privacy experts have expressed concerns that US user data could easily be compromised by the Chinese government, as ByteDance is based in China.

TikTok has consistently denied such claims, but that has not stopped local, state and federal politicians from trying to put guardrails on the platform out of national security concerns.

During his first term in office, Mr Trump also voiced worries about the Chinese-owned social media app, but during his 2024 presidential campaign, he joined TikTok and quickly gained millions of followers.

His initial 2024 opponent, President Joe Biden, who also signed the bipartisan legislation that could ultimately ban TikTok, also joined the platform.

At a news conference on Monday, president-elect Mr Trump promised to "take a look" at the coming deadline that might see TikTok banned.

"I do have a warm spot for TikTok in my heart," he said, pointing out that he believed his popularity on the platform might have helped him to win younger voters during the 2024 election.

Mr Trump stopped short of any specifics as to how he might prevent the app from being banned in the US and his options might be limited.

He could try to convince Congress to repeal the legislation, but that seems unlikely as it received bipartisan support.

It's not yet clear how long it will take the US Supreme Court to decide on the case, which is one of the few remaining options ByteDance has to save the app's presence in the US.

Just last week, US politicians sent letters to Apple and Google, notifying the technology giants that on January 19, if ByteDance divest TikTok from its portfolio, that the popular video sharing app would have to be removed from app stores.

The US is one of TikTok's largest markets, with more than 175 million active monthly users by many estimates.

India was once the platform's biggest market, with more than 200 million monthly users, before the app was banned in that country for similar national security reasons.