The idea of putting solar panels in space and beaming the energy to Earth was originally proposed in 1968.

The concept, envisaged by American aerospace engineer Peter Glaser, proved technologically and economically impossible.

Now, space-based solar power is being actively pursued by China, India, Japan, Russia, the US and the UK, and according to a study by King’s College London, has the potential to play a game-changing role in the drive to net zero.

Space-based solar panels could enable power to be harvested continuously instead of only when sunlight reaches Earth, a study published in Joule found. Researchers suggested it could reduce Europe’s need for Earth-based wind and solar by 80 per cent and could cut the cost of the continent’s total energy grid system by seven per cent to 15 per cent – an equivalent saving of about €36 billion ($42 billion) a year.

However, that hinges on the rapid development of two Nasa-designed technologies.

“In space, you potentially have the ability to position solar panels to always face the sun, which means power generation can be nearly continuous compared to the daily pattern on Earth,” said senior author and engineer Prof Wei He of King’s College London. “And, because it’s in space, the solar radiation is higher than on the Earth's surface.

“We're currently at a stage to transfer this blue-sky idea into testing at a large scale, and to begin discussing regulation and policymaking.

“Reaching net-zero emissions by 2050 is going to require a significant shift to renewable energy, and this emerging technology could play a pivotal role in that transition.”

Solar energy gathered in space is less likely to be affected by cloud cover and is safe from natural disasters such as flooding and earthquakes, which infrastructure on Earth is vulnerable to.

The panels would work much like communications satellites – orbiting Earth, rotating to optimally catch the sun’s rays, then beaming the energy to receiving stations in the form of microwaves, which could then be converted to electricity and fed into the existing grid infrastructure.

Prof He’s team estimated the annual costs and energy-harvesting potential for two space-based solar power designs from Nasa – the Innovative Heliostat Swarm and the Mature Planar Array.

The heliostat design is in the early stages of development but has higher potential to continuously capture solar energy, whereas the simpler planar array is closer to being technologically ready. However, the latter can only capture solar energy about 60 per cent of the time, but this still a big increase from the 15-30 per cent efficiency of standard Earth-based solar panels.

Prof He told The National the success of the two projects comes down to how quickly they can reduce the cost of producing energy while improving performance, which is “highly uncertain”.

However, he said he was “optimistic” it could be achieved “with a disciplined plan and clear check points” so improvements could be measured.

He said there were three strands which had moved the idea from a “thought experiment” in the 1960s to a testable path: rising PV performance (converting sunlight into electricity) and radiation-tolerant technologies; real wireless-power demonstrations – including Caltech’s recent low-power orbit-to-Earth beaming test; and costs being driven by industry through reusable launches and high-volume satellite manufacturing.

His team estimated the heliostat design was capable of offsetting 80 per cent of wind and solar, but to be cost-effective, its annual costs would need to decrease dramatically.

“We recommend a co-ordinated development strategy that combines and leverages both technologies to achieve better performance,” said Prof He.

“By first focusing on the more mature planar design, we can demonstrate and refine space-based solar power technologies while concurrently accelerating [research and development] for designs with more continuous power generation.”

The researchers note that many technological breakthroughs are needed before space-based solar power can be implemented.

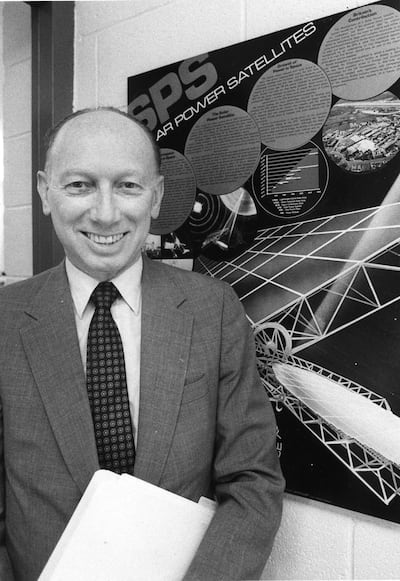

Who was Peter Glasner?

- Dr Peter Glaser was a Czech-born space tech pioneer who moved to the United States in 1948 where he studied mechanical engineering at Columbia.

- He is best known as the inventor of the Solar Power Satellite, a concept which he presented in the journal Science in 1968 under the title Power from the Sun: Its Future.

- Five years later, he was granted a US patent to supply power from space, however the satellite system was considered too large to launch economically from Earth.

- It was suggested it could be constructed in space, using lunar and asteroid materials, but it was never put into practice.

- Dr Glaser was project manager for the Apollo 11 Laser Ranging Retroflecter Array, which was installed on the moon in 1969.

- He served on several Nasa committees and was inducted into the Space Technology Hall of Fame in 1996.

- He died in 2014, aged 87.