The UAE Finance Ministry this year expects the approval of a federal debt law that will allow the government to sell bonds on a federal level, a ministry official said on Tuesday.

The ministry has been working on the federal debt law for years. Currently, individual emirates, mainly Abu Dhabi and Dubai, have tapped the international bond markets.

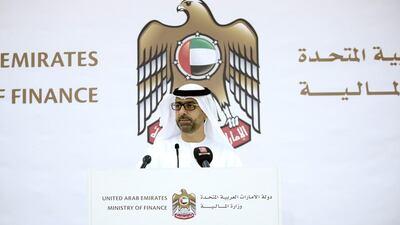

“We have one clause outstanding, which is the debt ceiling and the servicing of the debt,” said Younis Al Khouri, the undersecretary at the Ministry of Finance. “Once we agree with the central bank then we will go to the council of ministers for approval and after that is the FNC [Federal National Council] approval.

The UAE could raise between Dh80 billion and Dh100bn via a bond sale, Mr Al Khouri said in February.

Debt issuance in the UAE is expected to accelerate as the country seeks to finance a fiscal deficit, which reached 2.1 per cent of GDP last year, according to IMF estimates.

In April, Abu Dhabi raised US$5bn from the international debt markets, its first bond sale since 2009.

The IMF has called on the UAE to tap bond markets and the assets of its sovereign wealth funds rather than draw down its local bank deposits to balance its budget.

The IMF is forecasting that the UAE’s cumulative fiscal deficit will reach $18.4bn between this year and 2021 as low oil prices reduce government income.

As a result of expected higher debt issuance, the country’s gross public debt to GDP ratio is forecast to rise to 17 per cent next year from 16.6 per cent at the end of last year, the fund said. The debt-to-GDP ratio averaged 18.5 per cent between 2005 and 2013.

dalsaadi@thenational.ae

Follow The National's Business section on Twitter