We might be a month away from World Savings Day (October 31), but the push is on to get us to start saving wherever we are - or at least boosting what we are already putting away each month, if that is possible these days.

But what price the cost of saving?

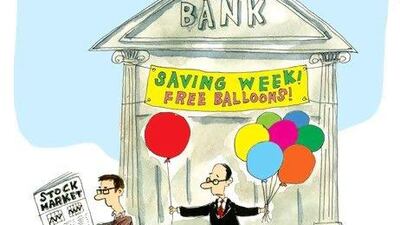

With banks offering little or no interest on savings accounts, is it really worth handing over our hard-earned money to a lender, which will then proceed to make a lot more off it than we do?

Some would argue it's not worth it; that there are better options to make a decent return on our savings, even in this age of austerity and market volatility.

The naysayers - and I know there's a lot of you out there - don't trust banks. And who would blame you? Combine hidden fees, the lowest interest rates on record (at least in my lifetime), multiple pages of terms and conditions (that, of course, favour the banks rather than the customers) and it's understandable you'd look for a better way to grow your money.

I know I do. Unfortunately, though, I'm caught in limbo. I have cash and I need to put it somewhere accessible until I find a property to buy. Which brings me to that other savings argument: banks can be a convenient place to park your money while you try to figure out what to do with it, despite the low interest rates they offer.

I need to have my cash available at all times because I am looking to buy a property. But that has left me stuck between a rock and a hard place. I have to leave my cash in the bank so I can get to it immediately, assuming I find a place to buy. But my search is taking a little too long for my liking. So the bank makes a better profit than I do on that cash of mine.

I don't need reminding that I'm probably - no, definitely - behind compared with what I had a few years ago.

But back to the push to get the world to start saving. It's not that we haven't been saving, it's just that our ability to save has been decimated by the financial crisis.

A lot of the middle class the world over are becoming the new poor, simply because they can't save like they did before. They have lost their jobs - and, therefore, their ability to pay for pretty much everything: their mortgages; their rents; personal loans; car payments; school fees; even food and utility bills.

No wonder we don't trust banks any more. I mean, at the end of the day, it was the banks, many of them described as being too big to fail, that caused this sorry mess we find ourselves in.

So, if our ability to save has been taken away by circumstances beyond our control, how do we get back on track?

Cashy.me, a website founded by Nima Abu-Wardeh to help people learn how to save and manage their money responsibly, has organised a campaign for UAE residents to start saving.

Called UAE Saves Week, it comprises fairly simple ideas to put money away as part of a themed seven-day plan. Pack your lunch instead of buying it, ride a bike to work (if you are brave enough), turn off your lights - there's a different theme every day.

It's a worthy cause, more so when you think about how much we don't save any more because our salaries are failing to keep up with inflation, utility bills are rising and the cost of food and travel is increasing. Every quarter, it seems.

But then David Kuo, the director of The Motley Fool, an investing website based in the United Kingdom, says it's time long-term savers became proper investors.

Forget the banks, says Mr Kuo. If you are a long-term saver and had put your money into the FTSE 100, you would have received a total return of 100 per cent over the past 10 years compared with a return of about 12 per cent in a typical instant access savings account in the UK.

"It is understandable for some savers to prefer the apparent stability of cash to the volatility of the stock market," says Mr Kuo.

"However, it is important to appreciate the difference between keeping some cash available for short-term needs and investing the rest over the long term to reap the benefits of generating real returns from shares."

I see the point of both arguments. But at the end of the day, you have to start somewhere to actually invest in stock markets. Which means having the savings to do so - and back to the basics for many of us.

Suddenly, that packed lunch is starting to sound like a good idea. Although I think I'll pass on the bike.