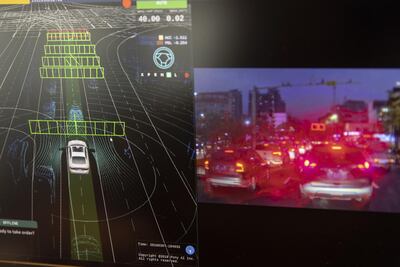

The autonomous Lincoln MKZ started turning left at a Beijing intersection when a speeding truck aggressively cut in front of it and sensors in the car detected the approach and instantly froze it in place.

But that put the Lincoln directly in the truck’s path, so Baidu engineer Sun Lei grabbed the steering wheel, spun it to the right and floored the accelerator to get out of harm’s way. The truck zoomed by as Mr Sun’s colleague in the passenger seat calmly took notes on a tablet computer - just another learning exercise for the self-driving fleet being tested around the nation, according to Bloomberg.

“We hope to see more interventions during the road tests so that we can improve our technology,’’ said Calvin Shang, general manager of strategy and operations for Baidu’s Intelligent Driving Group. “It won’t help if you only run the cars on simple routes even for 10,000 or even 100 million miles.’’

Although disaster was averted, the incident shows how China’s push into autonomous vehicles is barely out of first gear, with only a handful of cities allowing limited trials by search-engine giant Baidu, start-up Pony.ai, trucker TuSimple and others since last year. Domestic and foreign testers are putting cars, buses, trucks and delivery vans through self-driving trials to teach them how to navigate the notoriously congested streets of the world’s biggest auto market.

The nation is getting a late start in the burgeoning field, considering California has allowed public-road testing since at least September 2014. That’s enabling US developers to lap their China counterparts, with Alphabet’s Waymo logging millions of cumulative test miles in that state alone. But China’s chaotic traffic has the potential to boost the self-driving industry’s capabilities beyond those of the US.

“The US is ahead right now,’’ said Bill Russo, chief executive of Shanghai-based consultancy Automobility. “But China will soon make significant strides, and I am fully confident that by 2030 it will be a different game.’’

The Chinese government set next year as the target date for large-scale adoption of early-stage AVs, and it wants 10 per cent of all new vehicles sold by 2030 to be fully autonomous - meaning hands-off driving.

The stakes are high. China’s market for smart and internet-connected vehicles will generate 100 billion yuan (Dh55.08bn) in revenue by next year, the government forecasts. The technology is core to the “Made in China 2025’’ plan that’s central to the US-China trade war.

Yet China’s approach to self-driving cars has been considerably more conservative than with electric vehicles, an industry where it’s the global leader in sales.

China is so behind it ranks 20th of 25 countries in a KPMG index measuring their level of preparedness for autonomous vehicles. The Netherlands ranks first and the US fourth.

There aren’t any national US regulations, but 41 states support autonomous-vehicle testing. The leaders include California, Arizona and Florida, according to BloombergNEF. That compares with just 14 Chinese cities allowing public-road testing.

But even after billions of dollars of research and development, the technology for autonomous vehicles is still unproven in the US, and none of the early leaders are making money on it.

Waymo only deploys robotaxis in one suburb of Phoenix, Uber has spent more than $1bn without clear plans to launch a service, and Elon Musk recently said Tesla’s technology would lead to 1 million vehicles on the road that are fully capable of self-driving - a claim met with scepticism.

In China, the national government sets minimum guidelines for testing, and local authorities can augment those while issuing permits. Cities started issuing permits in March 2018, when Shanghai gave SAIC Motor access to remote suburban streets.

By comparison, California had issued permits to 63 companies as of February 2019. They include Tesla, Volkswagen, Toyota Motor – and 15 China-based testers developing algorithms and honing software and sensors.

“We can’t sit and wait to act,’’ said James Peng, chief executive and co-founder of Pony. “As the Chinese government gets to understand better what self-driving technology can achieve today while ensuring road safety, they’ll become more liberal and practical with the regulations.’’

The leading tester in China is Baidu, which covered about 140,000km in Beijing last year - less than a typical month for Waymo. No accidents have been reported. Foreign companies such as Daimler and BMW also test, but their roadwork is limited.

For Daimler, as well as other car makers, the cost of deveoping autonomous and electric vehicles can be onerous.

Pressure to develop electric and autonomous cars has led R&D costs at Mercedes-Benz passenger cars to rise to €14bn (Dh) from around €8bn four years ago, outgoing chief executive Dieter Zetsche said this week.

At the same time, China, the world's largest car market, has seen sales momentum slowing for nine months in a row, with a 5.2 per cent fall in sales of Daimmler vehicles in March, Reuters said.

Daimler's next chief executive will have a tough job to restore margins at Mercedes-Benz, Mr Zetsche said, as Mercedes-Benz launched a new luxury electric car to rival Tesla.

Mr Zetsche, who bows out as CEO on May 22, said the German luxury car maker needed to find a way to rebuild margins after research and development (R&D) costs ballooned.

"There are many challenges ahead. We are in a situation of an economic slowdown. It is not going to be easier going forward," he said on the sidelines of the launch event near Oslo.

Back in China, bureaucratic issues are slowing development. China’s permitting process is particularly cumbersome, said Neil Wu, a Shanghai-based partner at consultancy Roland Berger.

Local authorities require each car to accumulate some kilometres on closed tracks and to pass several tests before granting public-road permits, and some cities require companies to renew those permits every three months.

“The current rules on public-road testing in China are limiting the amount of data and number of traffic scenarios, the two key factors for improvement in the intelligence level of robocars,’’ Mr Wu said.

The nation also needs to unify its traffic regulations, since even the basic signs can differ from city to city, said Yin Ying, deputy head of Beijing Electric Vehicle’s Research & Development Centre. The car maker tests robocars in the capital city.

Baidu, owner of China’s biggest search engine, had permits for Beijing, Chongqing, Pingtan, Changsha, Baoding and Tianjin in the fourth quarter of last year, according to BNEF.

“The US is ahead right now”

The Beijing-based company, long labelled the Google of China, is developing the equivalent of an Android operating system for AVs. The Apollo platform has about 130 members - including Volkswagen, Ford, BYD and Microsoft.

Its target year for large-scale deployment in highly autonomous, or Level 4, vehicles is 2020. Full autonomy is Level 5.

During a test drive near Beijing’s Daoxianghu Park, Baidu’s Lincoln stopped several times while attempting left turns and braked on an empty street after its laser-based sensors misinterpreted sprinkler spray to be a solid object.

“The diversity in scenarios in China will help speed up the iteration of autonomous driving technology,’’ Mr Shang said.

After testing for six months on remote Shanghai roads, TuSimple now runs autonomous tractor-trailers from the Yangshan Port to a nearby railway station, said Xue Jiancong, a vice general manager for the start-up’s Shanghai office.

The company, which surpassed a $1bn valuation in February, also hauls containers in Arizona.

“We believe the Chinese government will speed up to break the policy limits," Mr Xue said.

Further south, Pony operates a fleet of 20 robotaxis inside the 50-square-kilometre Free Trade Zone in Guangzhou.

The start-up was founded in 2016 in Fremont, California, by ex-Baidu engineers Peng and Lou Tiancheng. It’s now valued at $1.7bn, with investors including Sequoia Capital China and IDG Capital.

A 3km autonomous ride from Pony’s offices to a Guangzhou hotel took about 12 minutes. The car reacted to erratic bicyclists, aggressive drivers and jaywalkers by slowing down, and it was one of the few vehicles obeying the speed limit.

The only sudden slowdown came when the vehicle’s rooftop sensors lost sight of the traffic light because of a tall truck.

The chaotic conditions are exactly what Mr Lou hopes for during the road tests.

“It is like a child learning how to swim,’’ he said.

“The harder the situation is, the quicker he learns.’’