The UAE is finding its footing as it positions itself to become a global artificial intelligence leader while maintaining its growing ties with China, after last week choosing to advance technology partnerships with the US over its eastern partner.

On Monday, Nvidia chief executive Jensen Huang said it is “imperative” for the UAE to scale up its investment in AI if it wants to become a leader in the next industrial revolution.

“The UAE is in a very unique position. It's able to work with everyone,” Mr Huang said during a discussion with Omar Al Olama, UAE Minister for Artificial Intelligence, the Digital Economy and Remote Work Applications, on the first day of the World Governments Summit in Dubai.

Last week Abu Dhabi AI company G42 sold its stakes in Chinese companies, including TikTok owner ByteDance, in a move seen to appease its US partners, the Financial Times reported.

G42 says it “cannot work with both sides” and retain access to AI chips made in the US, according to the FT.

In January, G42 denied any links with the Chinese government and military, dismissing the allegations as “unfounded and irresponsible”. While it acknowledged partnerships with “some” Chinese entities, “such engagements are standard practice among global technology companies”, it said.

“If the UAE's [latest] actions are perceived as aligning more closely with western tech interests, this could lead to diplomatic balancing acts,” especially between the world's two biggest economies and superpowers, says Howard Yu, a professor of innovation and research director at the International Institute for Management Development's Centre for Future Readiness.

However, the Emirates has “historically been skilled at maintaining balanced relations with various global powers”, Mr Yu told The National.

“Historically, the UAE and China have enjoyed strong economic and trade relations, with significant bilateral trade and Chinese investment in the UAE.”

Any sensitivity is more likely to arise from Washington than Beijing, Mr Yu said, given that the US has increasingly viewed the advancement of AI technologies within the context of its strategic competition with China.

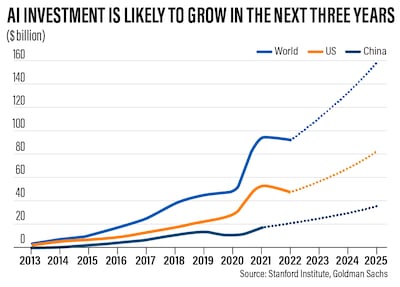

China has been investing heavily in AI domestically and internationally, seeking to develop and acquire the technologies to enhance its economic and industrial capabilities.

Therefore, Beijing might view the UAE's AI initiatives as part of a larger, global AI ecosystem from which it can benefit through co-operation rather than competition, Mr Yu said.

Mr Huang said the UAE would benefit from pouring more investment into graphics processing units (GPUs), dubbed by California-based Nvidia as the “rare Earth metals, even the gold” of AI, because they are foundational for today’s generative AI era.

GPUs perform technical calculations faster and with greater energy efficiency than traditional central processing units, resulting in leading performance for AI training and other applications that require accelerated computing.

GPUs were initially created to handle 3D graphics, most notably in games, but have evolved to become one of the most important types of computing technology, “both for personal and business computing”, according to US chip major Intel.

Any attempt by the UAE to position itself as a global GPU manufacturing hub, or at the very least be a source for its technology, could “significantly elevate its position in the global tech arena”, Mr Yu said.

“The benefits of such a development would include diversification of the economy away from oil dependence and job creation in high-tech sectors,” he said.

“But there are challenges. The semiconductor industry requires significant capital investment, with estimates for expanding global chip-building capacity running into trillions.”

Enter OpenAI, the Microsoft-backed creator of the highly popular ChatGPT that triggered a wild race in generative AI.

Last week, its chief executive, Sam Altman, was said to be in talks with investors, including the UAE government, to raise funds aimed at boosting the world’s chip-building capacity to power AI, the Wall Street Journal reported, citing people familiar with the situation.

The amount being aimed for? As much as $7 trillion.

“If the UAE can work aggressively with new players who are looking for alternatives … then the world can very well use and embrace a new cluster that can also play a more natural role in an increasingly politically fraught technological landscape,” Mr Yu said.

“These are interesting times for Gulf states. As the world pivots from Global North to Global South, they find themselves becoming empowered and feeling emboldened,” Simon Chadwick, a professor of sport and geopolitical economy at the Skema Business School in Paris, told The National.

The terms Global North and Global South are a method in which countries are grouped based on their socioeconomics and politics, according to the United Nations Conference on Trade and Development.

Global North primarily comprises Northern America, Europe, Japan, South Korea, Australia, New Zealand and Israel, while Global South groups Africa, Latin America, the Caribbean, Asia and Oceania, with the last two excluding those already in Global North.

“This puts [GCC nations] in an interesting position amid the political schism between the US and China. This means the likes of the UAE can hedge between the two superpowers, with a view to enhancing its own power and position,” Mr Chadwick said.

“Yet this is not simply about a binary choice for the UAE – it is also about positioning the country as an ascendant global power in its own right,” he said, noting the tech ambitions and investment capabilities of fellow GCC majors Saudi Arabia and Qatar.