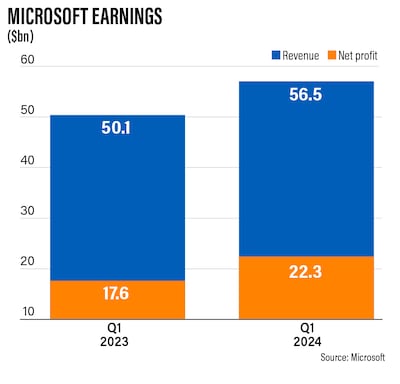

Microsoft shares rallied in after-hours trading on Tuesday after the company reported a 27 per cent increase in its fiscal 2024 first-quarter net profit, beating Wall Street’s revenue estimates.

Its net profit jumped to $22.3 billion in the three months to the end of September. The company’s profit was driven by strong productivity and cloud businesses.

Microsoft’s financial year ends in June.

Revenue during the July-September period jumped 13 per cent to $56.5 billion, exceeding analysts' expectations of $54.5 billion.

The company's stock, which has gained more than 37 per cent since the start of this year, surged more than 4 per cent to $344.20 a share in after-hours trading on Tuesday.

Its share price was $330.53 at market close, giving Microsoft a value of $2.46 trillion.

“With Copilots, we are making the age of AI [artificial intelligence] real for people and businesses everywhere,” said Satya Nadella, chairman and chief executive of Microsoft.

Launched in March, Microsoft 365 copilot brought the capabilities of next-generation AI to work, combining the power of large language models and generative AI with the company’s apps and platforms.

The company is expected to release its newest Copilot to all users from November 1, with the chatbot expected to radically shift productivity habits in the world's most used PC operating system.

“We are rapidly infusing AI across every layer of the tech stack and for every role and business process to drive productivity gains for our customers,” Mr Nadella said.

Revenue in Microsoft’s intelligent cloud division, which includes Azure public cloud, increased 19 per cent annually to $24.3 billion, higher than the $23.4 billion consensus of analysts surveyed by StreetAccount.

Sales from Azure and other cloud services, which Microsoft does not report in dollars, grew by about 29 per cent.

Since 2016, Microsoft has committed to building Azure into an AI supercomputer for the world, serving as the foundation of its vision to democratise AI as a platform.

“Microsoft exceeded both revenue and earnings per share expectations this quarter, thanks to a strong performance in its key Azure cloud business as well as fresh initiatives in AI,” Jesse Cohen, senior analyst at Investing.com, told The National.

“It is firing on all cylinders and AI is clearly driving growth. The results indicated that AI products are stimulating sales and already contributing to top and bottom-line growth.”

The company’s last quarter diluted earnings increased 27 per cent to $2.99 a share, compared to the $2.65 a share expected by analysts.

Its operating income surged 25 per cent to $26.9 billion in the previous quarter compared to the prior year period.

The company's productivity and business processes division, which includes both its Microsoft Office business and revenue from LinkedIn, surged 13 per cent to $18.6 billion in the September quarter.

LinkedIn revenue increased almost 8 per cent annually. Microsoft did not give a dollar figure for its LinkedIn revenue and did not disclose the number of users.

Subscribers to Microsoft 365 Consumer – a bundle of various apps – increased to 76.7 million at the end of the last quarter, up 14.4 per cent on a quarterly basis, the company said.

Sales in the personal computing division surged 3 per cent to $13.7 billion in the quarter.

Search and news advertising revenue excluding traffic acquisition costs increased 10 per cent, while devices revenue decreased 22 per cent.

Xbox content and services revenue increased 13 per cent in the first quarter.

Earlier this month, UK regulators cleared Microsoft's $69 billion acquisition of Activision Blizzard, the gaming company behind Call of Duty, Overwatch and World of Warcraft, reversing its earlier decision to block the deal, which is one of the largest tech transactions in history.

Microsoft also returned $9.1 billion to shareholders in the form of share repurchases and dividends in the last quarter.

The company spent more than $6.6 billion on research and development, about 12 per cent of its total sales in the quarter.

Microsoft’s total cash, cash equivalents and short-term investments stood at more than $143.9 billion as of September 30, compared with $111.2 billion at the end of June.