Technology manufacturers should broaden the range of applications, expand content beyond gaming and bring down the overall hardware and software costs to make augmented reality and virtual reality headsets mainstream and attract more users, according to analysts.

Looking at the current market dynamics – marked by looming economic recession, sinking disposable income and weaker consumer spending – it will be a long time before AR/VR headsets become ready for the mass market, they said.

“One of the biggest hurdles is content availability … the available content is niche [only appeals to certain users]. But even within that niche set of users, the available content is limited. At best, there may be high value for a small set of users for a limited amount of time,” Tuong Nguyen, director analyst at Gartner, told The National.

“Other barriers include lack of convenience – such as ease of use – accessibility to the device and affordability and control. That is a user-interface challenge which will be gradually overcome.”

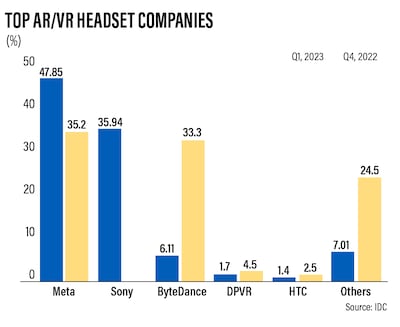

Global AR and VR headset shipments dropped for the fourth quarter in a row as volume fell 44.6 per cent annually in the three-month period that ended on June 30, according to the International Data Corporation, which did not disclose the exact figures.

Total shipments of AR/VR headsets are expected to drop 3.2 per cent annually to 8.5 million devices this year, the Massachusetts-based research company said.

“Consumers are under immense pressure when it comes to spending or disposable income. They are very much pushed to the corner and are very cautious about where they are spending money when it comes to technology and entertainment,” said Naeem Aslam, chief investment officer at Zaye Capital Markets.

“We believe VR [headsets] still has a long way to go … but yes, it is the future and could be the next big thing. Important factors will be the pricing of the products and how the companies are going to incentivise users to win their confidence.”

On Wednesday, Facebook-parent company Meta Platforms launched its latest mixed-reality headset Quest 3 (priced $499.99) that is geared towards a high-end market.

Meta occupied a 50.2 per cent market share during the June quarter, followed by Sony (27.1 per cent) and ByteDance (9.6 per cent), according to IDC.

In June, iPhone maker Apple also entered the market by unveiling its long-awaited AR headset Vision Pro, with prices from $3,499. The device will be available in the US early next year.

“In the long term, Meta will face competition from the likes of Apple, particularly as the market tries to move beyond the core gaming audience,” said Jitesh Ubrani, research manager at IDC.

“Currently, VR market is heavily focused on gaming … however, the next generation headsets are capable of providing experiences that will allow users to blend the virtual and real worlds together. This has the potential to gain a larger audience especially if developers create unique experiences for businesses and wider audiences.”

The Middle East market has been increasing spending on VR devices, “albeit slower than expected”, Akash Balachandran, research manager at IDC, said.

“The high ASPs [average selling prices] on popular devices, as well as the lack of locally relevant content has hampered otherwise quicker adoption [in the Middle East],” he said.

“Furthermore, as these devices are adopted by organisations, for instance, in educational institutions or in HR training use cases, we can further expect to see a pickup in overall shipments in the region.”

AR and VR seamlessly blend digital elements into the real world, elevating how users perceive and interact with their environment.

While AR enriches the real world with digital overlays, VR takes users on immersive journeys to computer-generated realms.

These experiences are enabled through VR headsets, equipped with display screens, motion sensors and audio systems, all working in concert to deliver interactive user experiences.

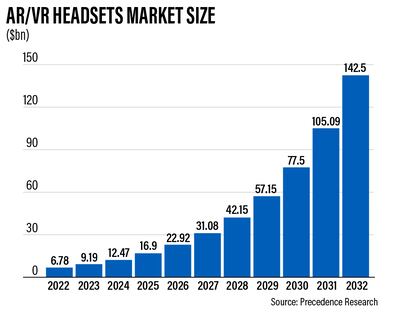

The global AR and VR headsets market is expected to reach $142.5 billion by 2032, from $6.8 billion last year, growing at a compound annual growth rate of 35.6 per cent, according to market researcher Precedence Research in Ottawa.

North America is expected to hold the largest market share worldwide. In the US, the AR headset market revenue is expected to hit $1.88 billion this year, from $1.84 billion last year, Statista said.

“Meta is more focused on games and experiences … it is looking for affordability to accelerate take-up and thus compromising on specs compared to other companies like Apple,” said Joao Sousa, senior partner at advisory and investment firm Delta Partners.

“But the key question is about when each approach will deliver volumes and adoption. The Vision Pro of Apple will be a niche for some time … two to three years until it scales. While Meta’s approach is very much limited to games, at least over the next few years.”

Meanwhile, some analysts are optimistic about the AR/VR headset market growth.

“When innovations first hit the market, they are always niche. However, we must understand the plasticity and spending power of [the] US consumers, who are always eager to be first on the next trend,” Thomas Monteiro, senior analyst at Investing.com, said.

“That said, VR is still a bet and one that depends on innovations that are not here today to become mainstream. The market is still taking baby steps, but the potential is already tremendous … the odds certainly look favourable, mainly due to the sheer amount of talent within those companies focused on making VR the next big thing.”

Meta’s Quest 3 will not be a game-changer, but it will lead the way to broad adoption of VR at the business-to-business level, Rolf Illenberger, founder and managing director of software development company VRdirect, said.

“For starters, Quest 3 is a great device at a great price. For enterprises looking to procure a large number of devices, Meta has just provided a great option. Meta has learned from Apple to emphasise the relevance of mixed reality,” Mr Illenberger said.

“Mixed reality provides a psychological bridge for users to start using extended reality devices while still feeling being part of their real world.”