The adoption of artificial intelligence by organisations has more than doubled in the past five years, with companies that spend more on the technology expected to reap more financial rewards, a McKinsey study has said.

The number of companies that said they used AI in at least one business area rose to 50 per cent, from 20 per cent in 2017, according to a survey by the global consultancy.

This reflects companies' growing awareness of the technology's importance to their strategy. The number peaked at 58 per cent in 2019.

The erstwhile “AI winter” has transitioned into an “AI spring” as more technology leaders at enterprises see the technology's value and have sought to successfully integrate this into their businesses, Michael Chui, a partner at the McKinsey Global Institute, wrote in the report.

“They not only invest more but they also invest more wisely, with the goal of creating a veritable AI factory that enables them to incorporate more AI in more areas of the business,” he said.

“This, at a high level, is an emerging formula for getting maximum value from AI … it is paying off in the form of actual bottom-line impact at significant levels.”

AI is a significant enabler in the digital transformation the world is currently experiencing as it can streamline business operations and user engagement.

The global AI market is projected to surpass $1.7 trillion in 2030, up from $93.5 billion in 2021, expanding at a compound annual growth rate of more than 38 per cent, data from Grand View Research shows.

Going high on the bottom line

About a quarter of respondents said that at least 5 per cent of their earnings before interest and tax were attributable to AI, which was consistent with the past two years, the McKinsey study said.

Going forward, spending on AI is poised to increase, with about two thirds of companies planning to increase their technology investment to keep pace with its growing adoption, according to the survey.

At present, half of respondents that use AI said that more than 5 per cent of their digital budgets went to AI, compared with 40 per cent five years ago.

“What we might be seeing is the reality of the level of organisational change it takes to successfully embed this technology sinking in at some organisations,” Mr Chui said.

Focus on optimising operations

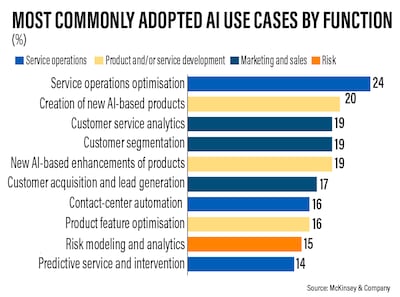

The optimisation of service operations was the most popular use case — and has remained so in the past four years — with almost a quarter of respondents saying they had used AI in this vertical, the McKinsey survey said.

Service operations, as a whole, were among the most focused areas in the top 10 use cases in the study, accounting for three, in a tie with marketing and sales, and product and marketing development.

The creation of new AI-based products, which falls under product and service development, was second with 20 per cent, while customer service analytics, under marketing and sales, came in third with 19 per cent.

Reducing AI's environmental impact

The impact of technology on the environment is well known, and companies are integrating AI into their sustainability efforts while also trying to mitigate its impact, the study showed.

partner at the McKinsey Global Institute

About 43 per cent of companies said they used AI to boost their sustainability initiatives while 40 per cent said they were working to reduce its environmental impact, it said.

Geographically, Greater China has the biggest number of enterprises using AI for sustainability (61 per cent), followed by the Asia-Pacific region (54 per cent), developing markets (44 per cent), Europe (39 per cent) and North America (30 per cent).

On the other hand, developing markets are on top when it comes to efforts to minimise the impact of AI on the environment, with 53 per cent of companies doing so, followed by the Asia-Pacific region (47 per cent), Greater China (46 per cent), Europe (36 per cent) and North America (31 per cent).

The race for talent is heating up

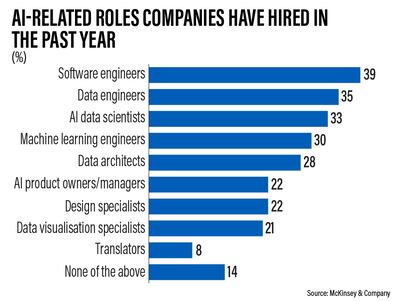

However, companies face challenges when recruiting top talent for AI, despite the fact that jobs in this area of technology are considered “hot roles”, the survey said.

Software engineers were the top hires in the past year at 39 per cent of enterprises, beating even data engineers (35 per cent), AI data scientists (33 per cent), machine learning engineers (30 per cent) and data architects (28 per cent), it said.

This is a “clear sign” that companies have considerably transitioned from experimenting with AI to actively using it in enterprise applications, it said.

However, the majority of organisations said they were having difficulties in hiring talent to fill these roles — AI scientists remain scarce, the study said — which could threaten the quicker adoption of AI.

An alternative, the report suggested, is to reskill or upskill present employees to keep pace with advancement and the competition.

“As the business value became clear, organisations realised the need for insights from AI to be delivered into a front end where people can consume and apply them for impact,” said Helen Mayhew, a partner at McKinsey.