More than half of the UAE consumers who responded to a survey plan to be cashless by 2024 compared to the global average of 41 per cent, according to a new report by Visa.

More than two-thirds (68 per cent) of the respondents in the UAE said they abandoned a purchase in the past few months because digital payments were not accepted by the merchant, the survey showed.

The coronavirus pandemic, which aided the shift to online payments and shopping in the UAE, led to permanent changes in habits, the FinTech company found.

More than 94 per cent of consumers in the UAE said they will continue to use digital payment channels as much as, or more than, in 2021.

“Payments are no longer about simply completing a sale ... it’s about creating a simple and secure experience that reflects one’s brand across channels and provides utility to both the business and its customer,” Visa’s general manager for the UAE, Bahrain and Oman Shahebaz Khan said.

Visa’s survey, which was conducted by Wakefield Research in December 2021, interviewed 1,000 people aged 18 years or more in the US, and 500 in the UAE, Brazil, Canada, Germany, Hong Kong, Ireland, Russia and Singapore.

It also surveyed 2,250 small business owners with 100 employees or fewer in the same countries to gauge their sentiments towards the digital economy.

The global payments industry was among the sectors where there were fast-paced changes during the pandemic, as consumers increasingly used digital platforms to shop, study and work online.

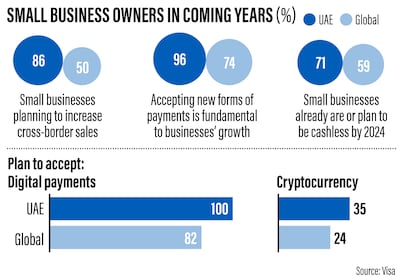

More than seven in 10 small businesses in the UAE, 59 per cent globally, already are, or plan to be, cashless by 2024 to meet their customers’ expectations.

Nearly 99 per cent of the businesses in the UAE attributed pandemic survival to selling online, with 58 per cent of their revenue now from e-commerce.

To fuel their growth in the coming months, small businesses are looking towards digital, including crypto-based payments and cross-border commerce, Visa said.

“The digital capabilities that small businesses built up during the pandemic – from contactless to e-commerce – helped them pivot and survive and by continuing to build on that foundation, they can now find new growth and thrive,” Mr Khan said.

More than 95 per cent of businesses surveyed in the UAE (74 per cent globally) said accepting new forms of payments is fundamental to their growth.

It suggests that digital payments are about finding growth in new digital realities, Visa said.

Nearly 93 per cent of small businesses in the UAE said they are optimistic about the future of their businesses.

All small business owners surveyed in the UAE (82 per cent globally) said they plan to accept some form of digital payments in 2022, including crypto, with 35 per cent (24 per cent globally) indicating a willingness to accept currencies such as Bitcoin, the biggest cryptocurrency.

The UAE Central Bank does not presently accept (or acknowledge) crypto-assets or virtual assets as a legal tender in the UAE. The only legal tender in the country is the dirham.

As a result of continued supply chain disruptions, consumers are also embracing the global marketplace, the survey said.

Almost 70 per cent of UAE consumers, compared to 59 per cent globally, are willing to buy internationally. The most persuasive factor cited for shopping on international e-commerce websites is positive customer reviews, Visa said.

Nearly 86 per cent of the businesses (50 per cent globally) also plan to increase cross-border sales in 2022.

However, a majority (96 per cent) of the UAE businesses find it challenging to accept and process cross-border payments, demonstrating demand for more faster and secure cross-border payment solutions, it said.